Registering a company in Croatia involves choosing a name and structure, preparing documents like the Articles of Association (notarized and translated), obtaining an OIB (tax number), opening a bank account, depositing share capital, and registering with the Commercial Court, Tax Admin, and Pension Fund, with streamlined e-services like START available for easier setup, especially for EU citizens.

If you’re still evaluating the bigger picture of doing business here, our Starting a Business in Croatia Handbook offers a broader overview of the entire ecosystem before you dive into formation details. If you’re ready for the application process, let’s start now!

Why the d.o.o. Is the Gold Standard for Foreign Nationals

A d.o.o. (društvo s ograničenom odgovornošću) is Croatia’s full Limited Liability Company and the structure most foreign nationals rely on when they decide to register a company in Croatia.

Most international founders from the US, UK, Canada, Australia, New Zealand, the EU, and beyond choose the d.o.o. because it signals stability and commitment. When you register a company in Croatia for investment, expansion, or residency purposes, banks and authorities expect to see a d.o.o. structure, not a simplified alternative. If your plans involve investment in Croatia, choosing the right corporate form from the outset is critical.

What Founders Ask Us Before Incorporation

Emily R. (United Kingdom): “I sell handmade nail products and digital goods online, mostly to clients outside Croatia. Should I start with a j.d.o.o. or a d.o.o.?”

Mandracchio Capital: Hello Emily. Because your business is low-overhead and largely international, a j.d.o.o. may look attractive at first. However, once residency planning and EU credibility come into play, a standard d.o.o. is usually the better long-term choice.

Marco B. (Italy): “I want to start a small wine business in Croatia. What structure makes sense?”

Mandracchio Capital: Hi Marco! In cases involving production, supplier contracts, distribution, or export, a d.o.o. is the appropriate structure. A j.d.o.o. often becomes limiting very quickly in this sector, especially when working with international partners or planning long-term growth.

Sophie M. (France): “I want to open a spa and wellness studio with local clients. Does the company structure really matter?”

Mandracchio Capital: Hi Sophie. Any business with a physical location, employees, inspections, or local permits is best structured as a d.o.o.. It provides a clear framework for leases, staff contracts, regulatory compliance, and ongoing operations. Simpler structures tend to create complications in practice.

Daniel K. (United States): “I’m planning a car-rental or a smart-space rental service aimed at both locals tourists. Can I use a simplified structure?”

Mandracchio Capital: For operational businesses involving vehicles, insurance, and liability exposure, a d.o.o. is essential. Insurance providers and regulators expect a structure that clearly limits personal liability and supports operational risk management.

Have a question? Send it to us via the contact form/ email below. We update this section weekly.

Have a specific situation?

If your case involves residency planning, company structure, or cross-border considerations, you can book a consultation with our team to review your situation in detail.

Opening a limited liability company in Croatia (d.o.o): The 10 steps Process

thay hninh 10 steps

Step 1: Choose a Name That Can Pass Croatian Registration

You’ll need a company name that is:

- Unique

- In Croatian or an EU language

- Written in Latin script

- Ending with “d.o.o.”

If you’re abroad, your Croatian lawyer can check, reserve, and clear the name for you.

Step 2: Define Your Business Activities

Before incorporation, you should decide what activities your company will do.

Croatia uses the NKD classification (business activity codes), and you’ll want to choose your NKD activities early because changing or expanding them later can add delays and extra admin steps.

Step 3: Obtain Your OIB (Personal Tax Number)

Every founder must have a Croatia OIB number before incorporation.

If you’re not in Croatia, your attorney can obtain it remotely with a power of attorney and apostilled documents.

Step 4: Sign and Notarize Incorporation Documents

A Croatian public notary oversees the signing of:

- Articles of Incorporation (or Statement of the Founder)

- Director appointments

- Registered address details

If you don’t speak Croatian, a certified court interpreter must be present. Any foreign documents require apostilles and official translations.

Step 5: Open a Temporary Bank Account & Deposit Share Capital

Minimum capital:

- €2,500-€2,700 for a standard d.o.o.

- Higher share capital is often requested in practice when non-EU founders apply for residence through their company. Requirements vary by police administration.

Banks may request additional compliance documents if you are a non-resident. This is normal.

Once capital is deposited, the bank issues a confirmation required for court registration.

Step 6: Register the Company with the Commercial Court

Your notary or lawyer submits the documents, and the Court formally creates your company.

Processing times:

- 3-10 business days (standard)

- 24 hours through e-Company (usually accessible only with Croatian digital ID)

After approval, you receive:

- The Court Decision

- The company OIB

At this point, your d.o.o. officially exists.

Step 7: Register with the Tax Authority

Your new business must be registered with Porezna uprava for:

- Corporate income tax

- VAT (if applicable)

- Ongoing reporting obligations

Corporate income tax is:

- 10% for turnover under €1M

- 18% above €1M

VAT (PDV) is 25%.

Step 8: Register with the Croatian Bureau of Statistics & Obtain Seal

After the company is registered with the Commercial Court, you must obtain the official NKD classification notice from the Croatian Bureau of Statistics (DZS/CBS).

This is done by submitting:

- RPS-1 form

- Court Register decision

- Company OIB

This step is typically completed after incorporation, and the company receives its official NKD activity code/classification notice.

Many companies also obtain a company seal (pečat). While it’s not always legally required today, banks and some institutions may still request it in practice.

Step 9: Arrange Accounting and Social Insurance Registrations

Accounting is mandatory in Croatia, and companies typically engage a licensed external accountant to handle:

- VAT filings

- Payroll (if applicable)

- Annual reports

- Corporate income tax submissions

The company also registers with:

- HZMO (pension)

- HZZO (health insurance)

If you’re a non-EU founder applying for residence, insurance enrollment is part of the process.

Step 10: Launch Operations & Apply for Residence (If Needed)

Your d.o.o. can now issue invoices, hire staff, sign contracts, and operate normally.

Foreign nationals-especially non-EU founders-may apply for temporary residence using the company as the legal basis. Additional capital requirements or staffing rules may apply depending on your specific permit pathway.

How to Open a d.o.o. Online in Croatia

Croatia’s START and e-Company platforms allow online formation, but with important limitations:

- They require a Croatian e-ID/digital certificate

- Most foreigners cannot open a d.o.o. online unless they already hold residency

However, your Croatian lawyer may be able to use the system on your behalf.

Online formation works best for:

- EU citizens

- Foreigners already holding Croatian residence permits

- Simple company setups

If you’re abroad, offline formation through a notary is usually faster and more reliable.

In Summary:

For Non-EU/Third-Country Nationals

- In-Person for Third-Country Nationals: Non-EU/EEA nationals generally must register in person and use a notary.

- Capital Requirements: Non-EU citizens may face higher minimum capital requirements (e.g., around €26,544.33 EUR (200,000 HRK) ) if they intend to work in Croatia as directors.

For EU/EEA Citizens

e-Osnivanje / START System: EU/EEA citizens can use these electronic systems for faster, cheaper registration (e-Osnivanje for EU/EEA, START for domestic/some foreigners).

Key Service Providers

- Public Notaries: Essential for notarizing documents.

- HITRO.HR: A one-stop shop for submitting documents and paying fees.

Required documents to open a limited liability company in Croatia

This guide explains exactly which Required documents to start a company in Croatia, how they differ for EU and non-EU founders, and how to prepare them properly so you don’t lose time, money, or business momentum: List of documents required to start a company in Croatia for Foreigner

Cost of Registering a Company in Croatia

Registering a company in Croatia typically costs between €500 and €1,500+ in administrative and legal fees, excluding share capital. A standard limited liability company (d.o.o.) requires a minimum share capital of €2,654.45, while a simplified LLC (j.d.o.o.) requires only €1.

Key cost components usually include:

- Notary fees: approximately €50-€400

- Court registration fees: approximately €8-€100

- Translation and legal support: approximately €500-€1,500+ (depending on documentation and complexity)

Costs vary based on the company structure, shareholder profile, and documentation requirements. For a full breakdown and real-world examples, see our detailed guide on the cost of registering a company in Croatia

How to Close a d.o.o. in Croatia

Closing a Croatian company depends on whether debts or liabilities exist.

Option A: Simple Closure (No Liquidation)

Used when:

- The company has no debts

- All shareholders agree

The notary files the closure decision, the Court publishes a notice, and after 30 days with no creditor claims, the company is dissolved.

Timeline: ~30 days

Cost: ~€199

Option B: Full Liquidation (With Liquidator)

Required when the company has:

- Debt

- Assets

- Outstanding obligations

The Court appoints a liquidator, the company name changes to “u likvidaciji”, and all assets and liabilities must be settled before final dissolution.

Timeline: Several months to one year

Cost: ~€332 + accounting/legal fees

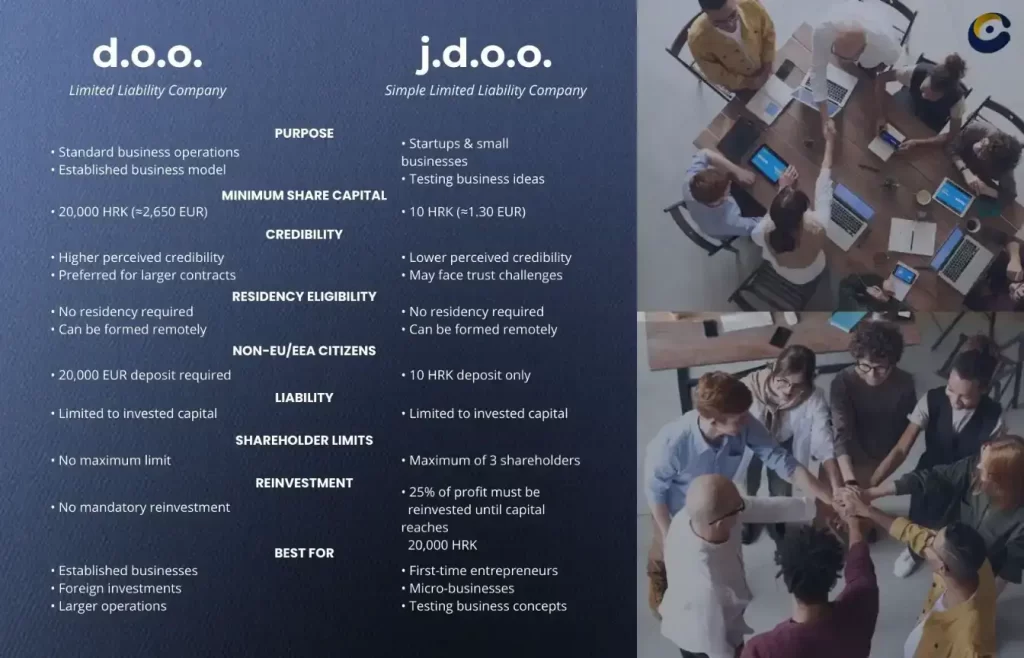

d.o.o. vs j.d.o.o.: Which Structure Should Foreign Nationals Choose?

A j.d.o.o. is better suited for Croatian locals testing a business idea, not for non-residents building serious operations.

For detail comparison, please read this: How to Start an LLC in Croatia: d.o.o. vs. j.d.o.o. (Which One Fits Your Business?)

Making the Right Decision as a Foreign Entrepreneur

If your goal is long-term business success, relocation, EU credibility, or structured investment, the d.o.o. is the right choice. It’s stable, respected, and aligned with the needs of international founders.

A j.d.o.o. may look attractive because of the low capital requirement, but for foreign nationals it usually creates more limitations than advantages.

When done correctly, opening a d.o.o. is straightforward, documents, court filings, tax setup, and banking all follow predictable steps. The challenge comes from small mistakes: untranslated documents, non-standard bank requirements, residency by investment misunderstandings, or incorrect business activities. That’s exactly why having the right legal guidance is essential.

Mandracchio Capital – Company Formation Services

Our business setup package is designed for standard company formations in Croatia and covers most founder and investor scenarios. It excludes large-scale investments, complex AML structures, and unresolved visa or residency issues. More complex cases can be supported following prior review and agreement.

All pricing is explained transparently upfront during a free introductory call, before any engagement begins.

The service is delivered in a concierge-style format. You receive a clear documentation checklist upfront, after which our team and trusted partners manage the full preparation and coordination process, minimizing delays, errors, and institutional back-and-forth.

What Our Professional Support Covers

Our support typically includes:

- Personal identification number registration

- Drafting incorporation and shareholding documents via licensed lawyers

- Business activity, licensing, and registered office guidance

- Notary coordination, translations, and court filings

- AML and beneficial ownership documentation

- Share capital deposit and statutory registrations

- Bank account opening, accounting onboarding, and e-invoicing setup

At Mandracchio Capital, our team also provide targeted coaching on early-stage operations in Croatia, including taxation, employment, social security, compliance, and local business practices, helping you start correctly and avoid costly fixes later.

FAQ

Is a j.d.o.o. enough to start a business in Croatia as a foreigner?

Technically, yes but practically, rarely.

A j.d.o.o. is designed for local Croatian entrepreneurs testing small business ideas.

For foreign founders, it creates problems with:

- Bank account approvals

- Residency applications

- Commercial credibility

- Investment and contracting

If you plan to relocate, open a bank account, sign serious contracts, or build an EU-facing business, a j.d.o.o. is usually the wrong tool. Most foreign nationals end up converting it into a d.o.o. later which costs more than doing it right from the start.

Why do banks and authorities prefer a d.o.o. over a j.d.o.o.?

Because a d.o.o. signals real capitalization, long-term intent, and financial substance.

Croatian banks, tax authorities, and immigration officers all evaluate whether a company is:

- Stable

- Properly funded

- Able to pay taxes, salaries, and obligations

A €1 company sends the opposite signal. A d.o.o. tells regulators you are building a legitimate EU business, not just opening a shell to get a permit.

Can I get Croatian residency through a j.d.o.o.?

In practice, no.

Immigration authorities expect a serious operating company if you apply for residence as a business owner or director. A j.d.o.o.:

- Has no meaningful capital

- Is legally restricted from distributing profits

- Is treated as a temporary startup vehicle

For non-EU founders, a d.o.o. with sufficient capitalization and activity is the standard route.

How much capital do non-EU founders really need for a d.o.o.?

Legally: about €2,500-€2,700.

In practice for residence and banking: often €20,000-€30,000+.

This is not a fixed rule, it varies by:

- Police administration

- Bank compliance team

- Your nationality and business plan

But Croatia expects non-EU founders to demonstrate that their company can actually operate, pay themselves, and support a residence permit.

If I only want a small online business, do I still need a d.o.o.?

If you are living abroad and only need a legal entity, a j.d.o.o. might be possible.

But the moment you need:

- A Croatian bank account

- EU payment processing

- Residency

- Business credibility

You will almost certainly need a d.o.o. anyway.

For most international founders, skipping straight to a d.o.o. avoids months of wasted time.

Can I upgrade a j.d.o.o. to a d.o.o. later?

Yes but it is not simple or cheap.

You must:

- Accumulate mandatory profit reserves

- Amend company documents

- Re-register with the Court

- Update bank and tax records

Many foreigners who started with a j.d.o.o. discover that they could have formed a d.o.o. for less money and less hassle at the beginning.

Does owning 100% of a d.o.o. as a foreigner create problems?

No. Croatia allows 100% foreign ownership of d.o.o. companies.

The issues are not ownership, they are compliance, banking, and residency alignment.

A properly structured d.o.o. is fully accepted under Croatian and EU law.

Is a Croatian d.o.o. respected in the EU?

Yes. A d.o.o. is Croatia’s standard EU-compliant limited liability company.

It can:

- Trade across the EU

- Open European bank accounts

- Sign international contracts

- Own property and IP

- Employ staff

A j.d.o.o., by contrast, is often treated as a starter or micro-entity.

Can I open a Croatian company remotely?

Yes, if you work with a Croatian lawyer.

You will need:

- Apostilled passport copies

- Power of attorney

- Translated documents

The lawyer handles notary, court, tax, and bank coordination on your behalf.

What is the biggest mistake foreign founders make?

Choosing a company type based only on minimum capital instead of long-term strategy.

A €1 company may look cheap but it often blocks:

- Bank accounts

- Residency

- Investors

- Serious contracts

Most successful foreign founders in Croatia start with a properly capitalized d.o.o. from day one.