Retiring in Croatia as an American has quietly shifted from a “hidden gem” idea into a realistic, well-planned retirement strategy for US citizens who want a safer, slower, and more affordable European lifestyle.

With its Mediterranean climate, strong healthcare system, and living costs that remain far below most US metro areas, Croatia offers something many retirees are actively searching for: a life that feels rich without feeling rushed.

This guide is written specifically for Americans considering retirement in Croatia. We’ll walk through visa and residency options, real monthly costs, the best places to retire in Croatia, and the practical things Americans who’ve already made the move wish they had understood earlier..

Why People Choose to Retire in Croatia

(And Why It’s Increasingly Ranked Among the Best Cities in Europe to Retire)

Lower Cost of Living

Compared with Western Europe and the US, the cost to retire in Croatia is noticeably lower. Many retired couples live comfortably on €1,200–€2,000 per month, depending on location and lifestyle.

Housing, food, public transport, and everyday services remain affordable, particularly when you step slightly outside historic centers or tourist hotspots. This makes Croatian cities attractive alternatives to more expensive European retirement favorites like Spain, France, or Italy.

Mediterranean Climate & Everyday Lifestyle

Coastal areas enjoy mild winters and long, sunny summers, while inland regions offer four clear seasons without extremes. Fresh food, local markets, outdoor walking culture, and clean air naturally support healthier aging.

Life here tends to move outdoors, morning coffees, seaside walks, evening promenades, without feeling rushed or performative. This lifestyle consistency is a big reason retirees rank cities like Split, Istria towns, and Zagreb among the best cities in Europe to retire rather than just seasonal destinations.

For a realistic picture of day-to-day life, beyond retirement planning alone, see our full guide to living in Croatia

Safety & Long-Term Stability

Croatia consistently ranks as low-crime, with a strong sense of personal safety, even in city centers at night. As an EU and Schengen member, it also offers political and legal stability that retirees value when planning decades ahead, not just a few years.

That peace of mind is often cited by retirees who compare Croatia with other popular European retirement destinations.

Central European Location

From Croatia, it’s easy to explore the rest of Europe. Italy, Slovenia, Austria, Hungary, and beyond are all a short flight or drive away. For retirees who enjoy travel but don’t want to constantly relocate, Croatia works as a stable home base with excellent connectivity.

This central positioning quietly strengthens Croatia’s standing among the best cities in Europe to retire, especially for those who want both rootedness and mobility.

Read more: Is Croatia a good place to live? Why move to Croatia? (answers from 9 expats)

Why Split?

For many Americans, Split hits a rare balance that’s hard to explain until you experience it. It’s a town big enough that everyone doesn’t know everyone, so you still have privacy and variety – but small enough that it never feels like a big city. You can walk most places, recognize familiar faces at cafés without feeling stuck in a bubble, and still access hospitals, ferries, and an international airport.

Nature is woven directly into daily life here. The sea is always close, parks and walking paths are part of the city fabric, and island escapes are a ferry ride away. Many retirees describe Split as the first place where they stopped feeling like they were visiting and started feeling like they were living.

That balance – between anonymity and community, energy and calm, urban comfort and nature – is exactly what draws many Americans to Split when retiring in Croatia.

“We didn’t move to Croatia to live cheaply, we moved to live well.”

— Mark H., former software consultant, Austin, Texas

Requirements to Retire in Croatia (For US Citizens)

Is there a Retirement Visa for Croatia?

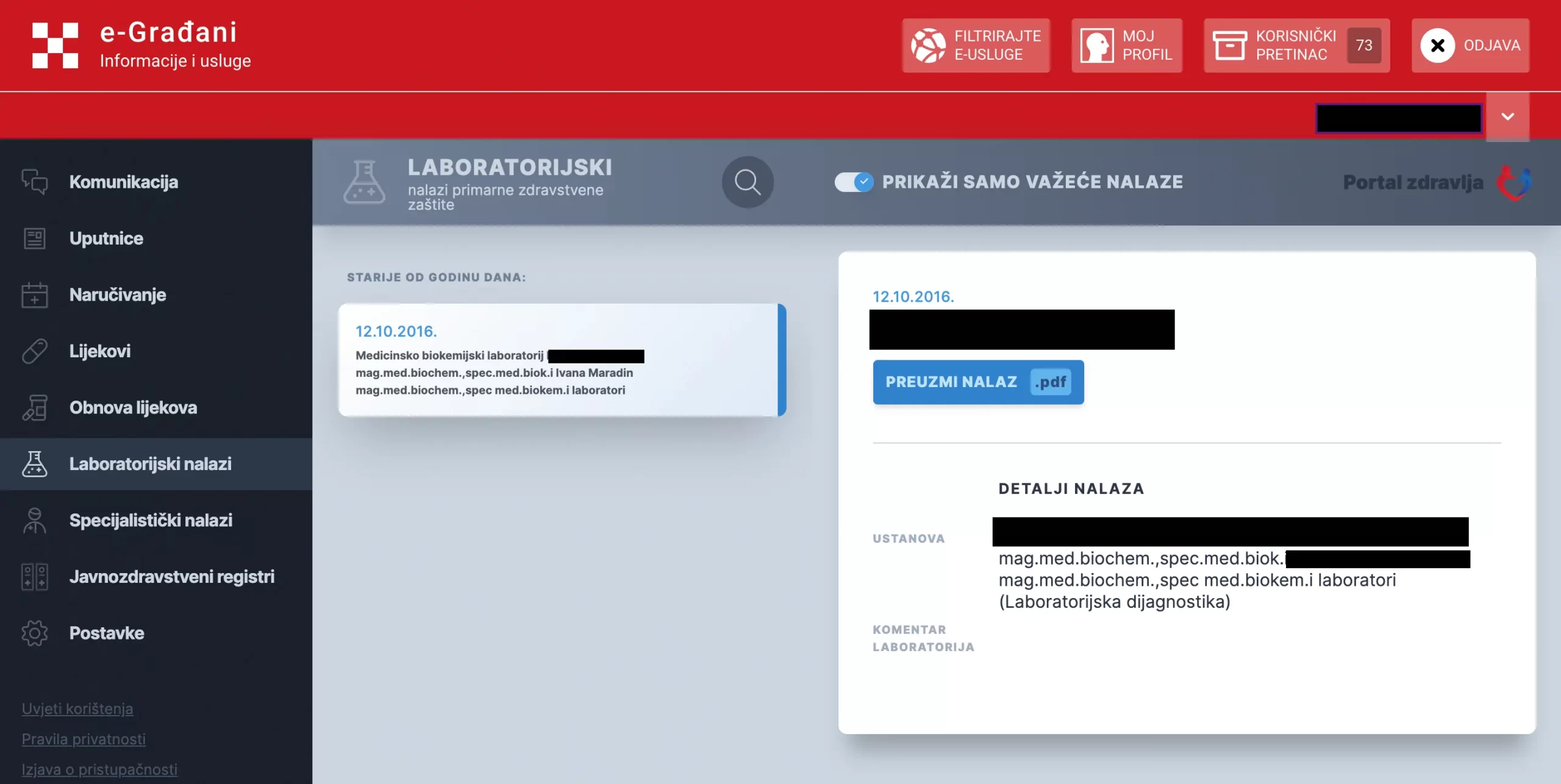

Croatia does not currently offer a dedicated “retirement visa” like some countries do. Americans retiring in Croatia typically apply for a Temporary Residence Permit (under one of the general categories available to non-EU (third-country) citizens). These permits can function as a way to live in Croatia as a retiree.

After entering Croatia (U.S. passport holders do not need a short-stay visa for up to 90 days), you must apply for a temporary residence permit if you plan to stay longer than three months. This application goes to the local police station in Croatia after arrival or sometimes through a Croatian embassy/consulate before arrival.

Examples of permit bases retirees commonly use include demonstrating secured accommodation in Croatia. In practice, this is most often done either by prepaying a long-term rental contract (typically 12 months in advance), which serves as evidence of stable housing and financial capacity, or by owning residential property in Croatia, such as a house or apartment suitable for long-term living. In both cases, the accommodation must be properly registered and documented, as Croatian authorities assess housing security as part of the temporary residence application rather than granting residence solely on age or retirement status.

Setting up a business and employing yourself as a director could allow U.S. retirees to apply for a residence permit in Croatia. However, this route can be costly, as you will need to cover business accounting costs and pay taxes on the director’s minimum salary, as well as contributions to health insurance, disability insurance, and public pensions.

At Mandracchio Capital, we advise foreign investors, business owners, and retirees on Croatian residency and business law, with a focus on compliant structuring and long-term legal certainty. Our work typically involves reviewing proposed residence paths, assessing regulatory exposure, and aligning business or investment structures with current Croatian requirements, taking into account each client’s specific situation.

Key Requirements to Retire in Croatia

- Proof of sufficient financial means (pension, savings, or investment income)

- Health insurance coverage

- Proof of accommodation (lease or property ownership)

- Clean criminal record

- Apostilled and translated documents

Typical Financial Thresholds: Around €460 per month for a single retiree (~$500+) is often cited as the minimum income or savings threshold required to qualify for residence based on self-support. About €660 per month for couples (combined). These figures are commonly referenced by immigration-oriented sites but are not always explicitly listed in Croatian immigration law, individual police stations sometimes interpret “sufficient funds” differently.

How You Demonstrate Financial Means: To prove you have sufficient funds, you may need to provide:

- Pension statements or proof of steady passive income

- Bank statements showing savings

- Proof of health insurance

- Proof of accommodation in Croatia (rental, property title, etc.)

Temporary residence is renewed annually. After five consecutive years, permanent residence becomes possible.

“The rules were clear, but the paperwork was intense. Having local guidance saved us months.”

— Linda R., former HR director, Chicago, IL

Cost to Retire in Croatia: What You Actually Spend

One of the most common questions we hear is how much money I need to retire in Croatia. The answer depends heavily on location and lifestyle but Croatia remains one of the most flexible retirement destinations in Europe.

How much money I need to retire in Croatia?

Typical Monthly Cost (Two People):

- Lean but comfortable lifestyle: $1,400–$1,600/month

- Mid-range lifestyle (more comfort, dining out): $2,200–$2,500/month

- Conservative annual target: €18,000–€24,000/year

Healthcare and groceries are affordable across the country; rent is the biggest variable.

“Our monthly spend in Split is about half of what we paid in California and our quality of life is better.”

— Susan & David M., retired teachers, San Diego, CA

Best Places to Retire in Croatia (For Americans)

Istria – Calm, Refined, and Easy to Settle Into

Rovinj · Poreč · Pula

If you picture retirement as peaceful mornings, good food, and a sense of order, Istria tends to click immediately.

This part of Croatia feels polished without being flashy. Towns are clean, organized, and used to foreign residents. You’re close to Italy and Slovenia, which shows up in the food, the wine, and the general rhythm of life.

You won’t find wild nightlife here, and most retirees see that as a plus.

What day-to-day life feels like:

- Slow mornings, long lunches, quiet evenings

- Local markets instead of megastores

- A strong sense of routine (which many retirees actually crave)

Costs to expect:

Most couples live comfortably on €1,600-€2,300 per month, depending on housing and lifestyle.

Best fit if:

You’re retiring as a couple and want calm, beauty, and long-term comfort, not constant activity.

Split – Coastal Life, But You Control the Pace

Split

Split is often where Americans first look, and it’s easy to see why. You have the sea, islands, hospitals, an airport, and a real city that actually functions year-round.

The key thing to understand about Split is this:

where you live matters more than how much money you have.

The historic center is busy and expensive. Move just 10–20 minutes outside, and life gets quieter, greener, and significantly cheaper.

What retirees like about Split:

- Easy access to hospitals and specialists

- Ferries to islands for weekend escapes

- An active expat and social scene (if you want it)

Realistic costs (two people):

- Basic living: around $1,800/month

- Comfortable lifestyle with dining and extras: $2,400–$2,500/month

Best fit if:

You want the option of social life and coastal energy, without being forced into it every day.

Zagreb – Predictable, Practical, and Healthcare-Focused

Zagreb

Zagreb surprises a lot of American retirees, mostly because it’s not on the coast.

But here’s the truth: if healthcare, stability, and predictable costs matter most, Zagreb is hard to beat.

There’s no tourist season driving prices up and down. Rentals are stable. Public transport works. Hospitals are the best in the country. Life feels normal, in a good way.

What daily life feels like:

- Quiet neighborhoods

- Cafés you visit every week, not once

- A strong sense of routine and safety

Typical monthly cost:

Most retirees spend €1,400–€2,000, depending on rent and habits.

Best fit if:

You care more about peace of mind and medical access than beaches outside your window.

Quick Comparison for US Retirees

| Location | Lifestyle | Healthcare | Typical Monthly Cost |

|---|---|---|---|

| Istria | Calm, refined | Very good | €1,600–€2,300 |

| Split | Coastal, social | Excellent | $1,450–$2,500 |

| Zagreb | Practical, stable | Best nationwide | €1,400–€2,000 |

Pros & Cons of Retiring in Croatia as an American

Pros

- Lower cost of living than most US cities

- Affordable, high-quality private healthcare

- Safe, walkable cities

- EU legal stability

Cons

- Croatian language is challenging

- Bureaucracy is document-heavy

- Coastal areas are busy in summer

Final Takeaway for Americans

Retiring in Croatia as an American isn’t about chasing the cheapest option, it’s about maximizing quality of life with realistic costs. Whether you prefer refined Istria, coastal Split, or practical Zagreb, the cost to retire in Croatia remains one of Europe’s most compelling value propositions for US retirees.

With proper planning, clear budgeting, and the right location, US citizens retiring in Croatia can enjoy a secure, comfortable, and deeply rewarding next chapter, without the financial pressure many experience back home.

FAQ: Retiring in Croatia as an American

Can Americans retire in Croatia if they are not on Social Security yet?

Yes. Retiring in Croatia as an American does not require Social Security income.

US citizens retiring in Croatia can qualify for temporary residence by showing other stable financial means, such as savings, investment income, dividends, rental income, or private pensions. Many Americans retire in Croatia in their 50s or early 60s using portfolio income rather than Social Security.

What sort of extended stay visa is available for Americans retiring in Croatia?

Americans typically apply for a Temporary Residence Permit. US citizens can stay visa-free for 90 days, but long-term retirement in Croatia requires approved temporary residence, which is issued for one year and renewed annually. After five consecutive years, permanent residence may be possible if requirements continue to be met.

What are the financial requirements to retire in Croatia as an American?

To meet the requirements to retire in Croatia, Americans must show proof of sufficient funds to cover living costs without working locally. In practice, this usually aligns with the cost to retire in Croatia, commonly around:

- €1,200–€1,500 per month per person, or

- Equivalent savings covering a full year of expenses

The exact amount can vary slightly by local authority and household size, but the goal is to demonstrate financial independence.

How much money do I need to retire in Croatia comfortably as a US citizen?

Most US citizens retiring in Croatia plan for:

- $1,400–$1,600/month for a lean but comfortable lifestyle

- $2,200–$2,500/month for a mid-range lifestyle with dining out and travel

Location matters significantly living outside tourist centers can reduce costs by 20-40%.

Do Americans need private health insurance when retiring in Croatia?

Yes. Americans must show health insurance coverage when applying for temporary residence. Many retirees use international private insurance initially, then transition to local options once registered. Healthcare costs are generally far lower than in the US, making retire in Croatia a financially sustainable option long term.

What are the best places to retire in Croatia for Americans on a budget?

For Americans prioritizing affordability:

- Zagreb offers the most predictable costs and best hospitals

- Smaller towns near Split (but outside the old town) provide coastal living at lower rents

- Inland regions can reduce living costs significantly, though English use is less common

These locations consistently rank among the best places to retire in Croatia when balancing cost, healthcare, and quality of life.