If you’re a foreign investor looking at Croatia, you’re probably not just asking “How do I register a company?”

You’re asking bigger questions:

Will this structure actually work for me?

Can this support residency or long-term plans in the EU?

Company formation in Croatia isn’t just paperwork. For international founders, retirees, and investors, it’s a strategic choice that affects everything from liability and taxes to banking access and whether your presence in Croatia is legally sustainable over time.

This guide walks you through company formation in Croatia by structure, so you can clearly see which options make sense for real business, which support investment or residence plans, and which ones look simple on paper but create problems later.

How Company Formation in Croatia Works (Context for Non-Croatians)

In practice, company formation in Croatia usually means incorporating a Croatian legal entity, most commonly a limited company, through a formal court-based registration system.

Foreigners are allowed to fully own Croatian companies, and there is no general requirement for a Croatian shareholder. However, the type of company you choose determines what you are legally allowed to do afterward.

Most foreigners who explore Starting a Business in Croatia underestimate how much the structure itself matters.

Company Registration in Croatia: Application process

Forming a company in Croatia requires selecting the appropriate legal structure (most commonly a d.o.o. or j.d.o.o.), securing a company name, notarizing the founding documents, depositing the required share capital, and registering the company with the court and relevant tax and statistical authorities, often through HITRO.HR. Founders must obtain an OIB (Croatian personal identification number), open a business bank account, and meet any additional conditions linked to residency status. The process is accessible to foreign nationals, including non-EU citizens, who are permitted to fully own Croatian companies.

In Croatia, a company can be established through several channels. Croatian citizens can use fully electronic one-stop systems such as START or START Points, which allow limited liability companies (d.o.o. and j.d.o.o.) to be formed without notarization. EU/EEA citizens may also use the e-Court Register, though some steps are handled separately. For non-EU founders, however, incorporation is typically completed through physical procedures, involving a notary, the Commercial Court, and additional registrations handled sequentially.

1. Choose Business Structure & Name

Select the legal form (e.g. d.o.o., j.d.o.o., joint-stock company) and reserve a unique company name with the Commercial Court.

You must check whether your company name is available using the Name Check service on the Court Register Insight interface.

Read more: How to Start an LLC in Croatia: d.o.o. vs. j.d.o.o. (Which One Fits Your Business?)

2. Prepare Founding Documents

You will need notarized founding documents, depending on the number of founders:

- One founder: Declaration of incorporation

- Two or more founders: Articles of Association

The Articles of Association typically define:

- company name

- registered office

- share capital

- founders’ rights and obligations

- appointment of management (and supervisory board if applicable)

All founders must sign, and the document must be made as either:

- a notarial deed, or

- a private document certified by a notary

It can also be prepared electronically or through electronic communication means (depending on the setup and signatures).

3. Notarization

All founding documents must be notarized in Croatia (directly or via power of attorney).

4. Capital Deposit

The share capital must be deposited into a Croatian bank account:

- d.o.o.: minimum capital typically cited as €2,500 (historically HRK 20,000) paid into a temporary account at a bank or via FINA

- j.d.o.o.: minimum capital €1

Important rule:

- before Court Register entry, each founder must pay at least 1/4 of their acquired share in cash

- the full cash contribution must be paid within one year from registration

5. Commercial Court Registration

You submit to the competent commercial court:

- notarized documentation

- proof of paid share capital

- court fees

After registration, the court issues the registration decision and assigns the OIB (Personal Identification Number), then forwards this to the notary or FINA.

6. Tax & Statistics Registration

The company is registered with:

- Tax Administration / FINA

- Croatian Bureau of Statistics (CBS)

To receive the official NKD classification (Notice on the Classification of Business Entities), you submit to the Croatian Bureau of Statistics:

- RPS-1 form

- a copy of the Court Register entry decision

- the company’s OIB certificate

The company must be registered in the corporate taxpayer register via the RPO form (based on the registered office). If relevant, you also submit the VAT registration request (P-PDV form) to the Tax Administration office according to the company’s registered seat.

7. Business Bank Account

Once court registration is completed, the official corporate bank account is opened and activated.

Detailed timelines and execution steps are covered in our separate procedural guide: How to Start a Company in Croatia 2026 Foreign Founder Guide

This process is standardized and predictable, but company formation in Croatia only works smoothly when the correct entity is chosen at the beginning. Since Croatian banks apply strict KYC and AML procedures, foreign founders should prepare in advance. You can review the full banking process in our article on opening a corporate bank account in Croatia.

As Croatia follows European Central Bank policy, future developments like the ECB Digital Euro project may reshape payment infrastructure for newly established companies.

Establishment of a Company in Croatia: Registration Channel

1) START (One-Stop Shop)

START system is the most streamlined route for locals.

- Who it’s for: Croatian citizens

- What can be established: d.o.o. (LLC) + j.d.o.o. (simple LLC)

- How it works: fully electronic, “all steps in one place”

- Notarization: not required

2) START Point (Physical)

A physical version of the START system

- Who it’s for: Croatian citizens

- How it works: registration steps are completed electronically, but you go in person to one of the START Point locations (20 locations)

- Notarization: not required

3) e-Court Register

This is the “digital formation” route for EU/EEA founders.

- Who it’s for: Croatian + EU/EEA citizens

- What can be established: d.o.o. + j.d.o.o.

- How it works: electronic establishment is possible, but other steps still need to be handled separately (often physically)

Required documents to Start a company in Croatia for Foreigner

Here’s the list of documents required to start a company in Croatia, how they differ for EU and non-EU founders, and how to prepare them properly so you don’t lose time, money, or business momentum.

Common Company Types in Croatia

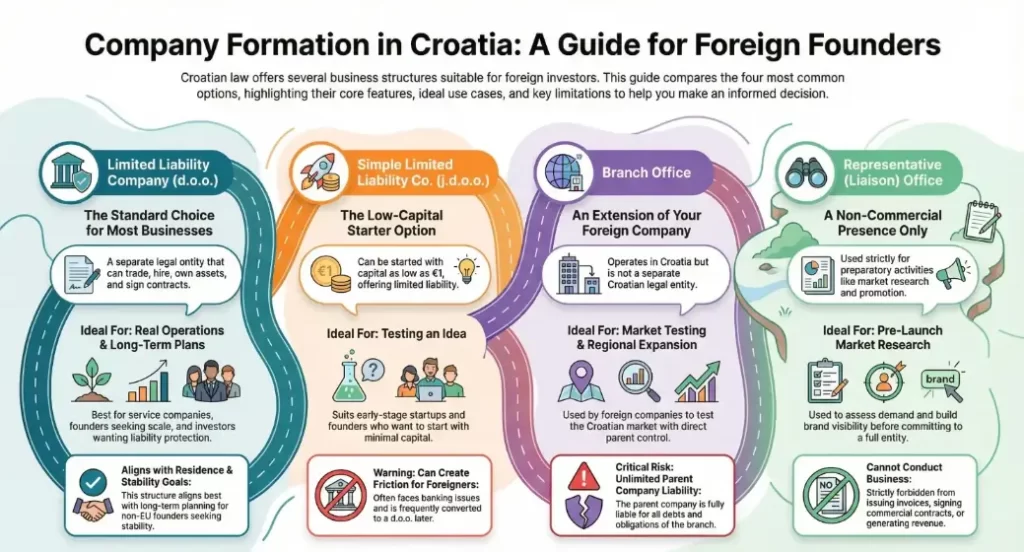

Croatian law offers several business structures, but in practice, foreign investors usually choose between the following three.

Limited Liability Company in Croatia (d.o.o.)

The društvo s ograničenom odgovornošću (d.o.o.) is the most common structure for company formation in Croatia.

What this structure really offers

A d.o.o. is a separate legal entity that can:

- operate commercially

- issue invoices

- sign contracts

- hire employees

- own assets

- engage in EU-facing trade

This is the structure people usually mean when they talk about a limited liability company in Croatia.

Who this is for

- business owners running real operations

- service companies working with EU clients

- founders planning scale and banking stability

- investors who want liability protection

For retirees and relocation-driven founders

Some non-EU individuals use a d.o.o. not to build a large enterprise, but to create lawful economic substance while doing business in Croatia for non-EU nationals in a modest but compliant way.

Important: company ownership alone does not grant residence rights, but among all options, this structure aligns best with long-term planning.

Learn how to Register a limited liability company in Croatia

Simple Limited Liability Company (j.d.o.o.)

What it is

- minimum capital as low as €1

- limited liability

- simplified setup

- mandatory profit retention rules

Who it fits

- early-stage startups

- founders testing an idea with minimal capital

Who should be careful

For foreign investors, retirees, and EU-facing companies, this structure often creates friction with banks and limits flexibility. Many founders later convert it into a d.o.o., adding cost.

Joint Stock Company (d.d.)

A dioničko društvo (d.d.) is Croatia’s structure for large enterprises and capital-intensive projects. It is the most complex option under company formation in Croatia and is designed for scale, not simplicity.

What it is designed for

- large capital investments

- multiple shareholders

- formal corporate governance

- potential stock exchange listings

Who it fits

- institutional investors

- large foreign corporations

- capital-intensive projects

Who it does not fit

- small businesses

- retirees

- lifestyle or relocation-linked structures

Due to complexity and governance requirements, this structure is rarely used by startups or service companies.

Branch Office in Croatia

A branch office allows a foreign company to operate in Croatia under its original legal name, without incorporating a separate Croatian legal entity.

What a branch office really means

A branch is an extension of the parent company, not a new company. From a legal and risk perspective, this distinction is critical.

Key characteristics

- Not a separate legal entity

- The parent company bears unlimited liability for all obligations and losses

- A local legal representative must be appointed

- The branch can conduct commercial activities

- Financial statements must be filed in Croatia

When a branch office makes sense

This structure is most often used by:

- Foreign companies testing the Croatian market

- EU companies expanding regionally

- Businesses that want direct control from the parent company

- Short- to mid-term operations without long-term structuring

When a branch office is risky

A branch office is usually not suitable if:

- Liability protection is important

- Long-term asset ownership is planned

- The parent company wants risk ring-fencing

- The activity may later require restructuring into a subsidiary

For many foreign founders, a branch is a temporary solution, not a final structure.

Representative (Liaison) Office

A representative (liaison) office is a non-commercial presence used strictly for preparatory or support activities.

What a representative office can do

- Market research

- Promotion and branding

- Liaison with business partners, institutions, or clients

What it cannot do

- Issue invoices

- Sign commercial contracts

- Generate revenue

- Engage in trading or service delivery

How this structure is typically used

Representative offices are commonly used for:

- Early-stage market entry preparation

- Brand visibility before formal operations

- Coordinating with distributors or partners

- Assessing demand before committing to a full entity

Important limitation

Because it cannot conduct business activity, this structure is not suitable for operational purposes and cannot be used to replace a company or branch.

How much does it cost to register a company in Croatia?

Registering a company in Croatia typically includes official registration fees, professional service costs (legal/accounting), and mandatory share capital.

Official registration fees (approx. €200–€500+)

Typical government/notary-related costs may include:

- Notary public: ~€331.81

- Commercial Court registration: ~€53.09

- Central Bureau of Statistics: ~€7.30

- Publication in Narodne novine: ~€119.50

(may vary depending on the setup and documentation)

Professional services (legal + accounting support)

Many foreign founders also use legal and accounting professionals to handle the process correctly, especially when the company is tied to residence, regulated activities, or foreign ownership structure. Fees vary depending on complexity, so it’s best practice to book a consultation first and confirm pricing upfront.

Mandatory share capital

This depends on the company type:

- d.o.o. (standard LLC): typically around €2,654 in share capital

- j.d.o.o. (simplified LLC): €1 share capital

Ready to Form a Company in Croatia?

If you are planning company formation in Croatia, especially a d.o.o., legal certainty from the first day matters. For foreign founders and investors, the most efficient path is working with professionals who understand Croatian corporate law, foreign ownership rules, and the procedural steps required to register and operate a company correctly.

At Mandracchio Capital, our role is straightforward: guide you through company formation in Croatia so your structure is compliant, functional, and suitable for your long-term business or relocation goals. If you are evaluating whether a d.o.o. is the right structure for your situation, your next step is to assess your options with guidance from professionals who work with international founders every day.

Benefits of doing business in Croatia

Is Croatia a good country to start a business for foreigners? For both EU and non-EU founders, Croatia stands out for its combination of stable legal framework, 100% foreign ownership, competitive corporate tax rates, investment incentives, strong English-speaking STEM talent, and high quality of life. These advantages are especially valuable for founders who plan to hire locally, scale gradually, and live where they operate. Discover 13 Key Benefits of Doing Business in Croatia for Foreigners

Your Legal Partner for Doing Business in Croatia

Many foreign founders can technically register a company in Croatia without full legal support, but in practice, professional guidance saves time, money and avoids delays especially if you don’t speak Croatian or you’re unfamiliar with the local system. Here’s why many clients choose to work with us:

- Language barrier + paperwork risk: Most procedures, forms, and communication with institutions are handled in Croatian. A small misunderstanding can lead to rejected filings, repeated appointments, or missing documents.

- Croatia is not “copy-paste” from your home country: Company formation rules, banking expectations, and compliance steps can be very different from what founders are used to in the US/UK/EU. Our lawyers helps you avoid setting up the wrong structure from day one.

- Correct structure from the start (so you don’t pay twice): The biggest cost is often not the registration fee,it’s fixing mistakes later (wrong company type, unclear ownership setup, wrong business activity codes, incomplete corporate documents, etc.). A proper setup helps you build on a clean foundation.

- Risk prevention + “what can go wrong” forecasting: Our lawyers don’t just file documents, they anticipate issues before they happen, especially in more complex cases (foreign ownership, regulated activities, residence-related setups, partner/shareholder arrangements, or cross-border compliance).

- Smooth coordination with accounting and ongoing compliance: Your company must stay compliant after registration (tax registrations, reporting, payroll rules if hiring, etc.). Legal + accounting coordination helps keep everything aligned and avoids surprises.

At Mandracchio Capital, we support international clients looking to build, move, or expand their businesses in Croatia with clarity and regulatory confidence. With 500+ projects supervised, over €500 million in company value established, and a network of 100+ expert advisors, we act as a reliable partner for HNIs, investment funds, corporations, and senior executives, coordinating trusted Croatian lawyers and tax consultants to ensure your company setup, compliance, and documentation are handled correctly so your business enters Croatia with precision.

FAQ – Company Formation in Croatia

Is company formation in Croatia available to foreigners?

Yes. Company formation in Croatia allows 100% foreign ownership, including EU and non-EU nationals, provided legal and tax requirements are met.

Can I use company formation in Croatia just to get residence?

No. Company formation in Croatia does not automatically grant residence or permanent stay. Authorities assess substance, activity, and compliance.

Which structure is best if I want to invest but not operate daily?

A d.o.o. is most often used when investors want flexibility and liability protection without day-to-day involvement.

Is Croatia 5 years no income tax?

No. Croatia does not offer a “5-year no income tax” rule.

This is a common myth often confused with:

- Tax incentives in other countries

- Temporary local reliefs

- Misunderstood digital nomad tax exemptions (which are residence-specific, not universal)

There is no automatic tax-free period for new residents or business owners.

What is the LLC equivalent in Croatia?

The Croatian equivalent of an LLC is the d.o.o. (društvo s ograničenom odgovornošću). This is the standard and most credible company form used by foreign investors, entrepreneurs, and relocating founders.

What are the costs of opening a company in Croatia?

Opening a company in Croatia typically involves registration fees (around €200–€500), professional services such as legal and accounting support (depending on complexity), and mandatory share capital, usually around €2,600 for a standard d.o.o. or €1 for a simplified j.d.o.o.

Ongoing costs such as accounting, compliance, and registered office services also apply. In practice, total initial setup costs can range from under €100 for a basic online j.d.o.o. to several thousand euros for more complex company structures or foreign-owned setups.