On paper, Croatia digital nomad visa requirement looks straightforward. In practice, many eligible applicants face delays, follow-up requests, or outright rejections because of how documents are prepared, where they apply, or small wording issues that aren’t explained in official checklists.

This guide is written for remote professionals who want to apply once and get it right.

Key Takeaways for the Croatia Digital Nomad Permit

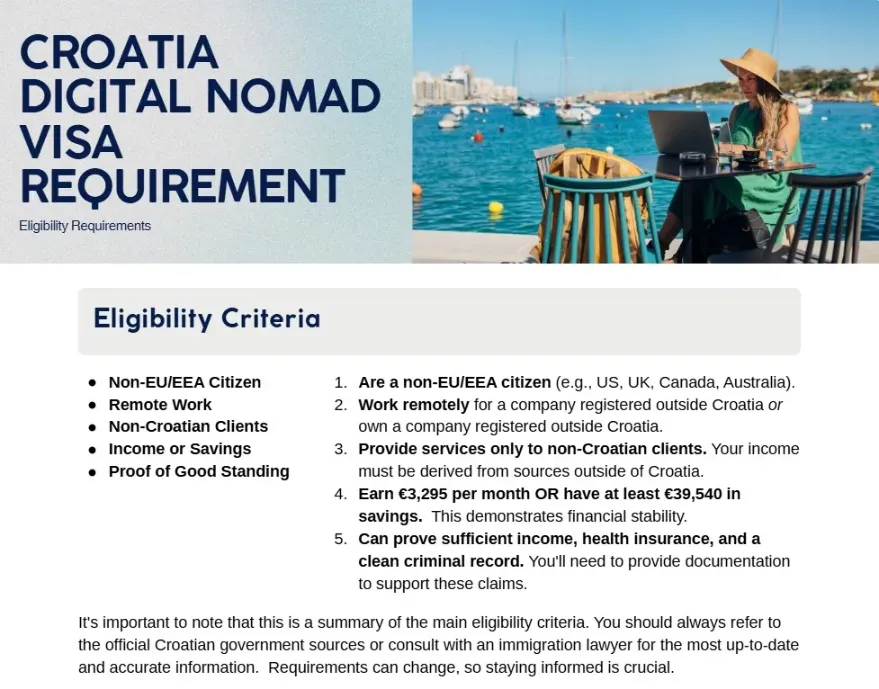

- Eligibility: Open to non-EU/EEA citizens working remotely for non-Croatian companies or clients.

- Income threshold: Minimum €3,295/month (or sufficient savings), with the figure indexed and updated over time.

- Tax relief: Qualifying foreign-sourced income is not taxed in Croatia under this permit.

- Duration rules: Stay up to 18 months total (initial permit + one extension), then a mandatory 90-day exit.

- Paperwork matters: Most delays come from small issues—unclear employer letters, inconsistent income proof, missing apostilles, or weak accommodation evidence.

Launched in 2021, Croatia Digital Nomad Visa is not a classic visa, but a temporary residence permit issued under the Law on Foreigners. Understanding the Croatia digital nomad visa requirement from the start is essential, because this permit operates very differently from a standard work visa.

The permit allows third-country nationals (non-EU/EEA) to legally live in Croatia while working remotely for foreign employers or clients, provided they meet each Croatia digital nomad visa requirement set by the authorities.

Key points you must understand upfront when reviewing the Croatia digital nomad visa requirement:

- This is not a Croatian work permit

- You cannot work for Croatian companies

- You do not pay Croatian income tax on foreign-sourced income

- It is temporary and does not lead to permanent residence

“Croatia designed this permit to attract long-stay professionals without burdening the local labor market.”

— Insight from our EU immigration team

Who Is Eligible?

To meet the Croatia digital nomad visa requirement, you must clearly fall within the defined eligibility criteria.

- Are a non-EU/EEA citizen (US, UK, Canada, Australia, etc.)

- Work remotely for:

- A company registered outside Croatia, or

- Your own company registered outside Croatia

- Provide services only to non-Croatian clients

- Earn €3,295 per month OR have at least €39,540 in savings

- Can prove sufficient income, health insurance, and a clean criminal record in line with the Croatia digital nomad visa requirement

EU citizens do not apply under this program they follow EU free-movement rules instead.

Croatia Digital Nomad Visa Income Requirements (2026)

The income threshold is the most searched , and most misunderstood, part of the Croatia digital nomad visa requirement.

| Requirement | Detail |

| Minimum Income | At least €3,295 per month (2.5x the average Croatian net salary). |

| Savings Alternative | Proof of €59,310 in savings if applying for the full 18-month stay. |

| Tax Status | You remain exempt from Croatian income tax on foreign-sourced income. |

| Health Insurance | Must cover the entire duration of your intended stay. |

Minimum Monthly Income

To satisfy the Croatia digital nomad visa requirement, you must prove at least:

€3,295 per month, calculated as 2.5× the Croatian average net salary

Savings Alternative (Instead of Monthly Income)

| Stay Duration | Monthly Equivalent | Total Savings Required |

| 1 Month | €3,295.00 | — |

| 12 Months | €3,295.00 | €39,540.00 |

| 18 Months | €3,295.00 | €59,310.00 |

Required Documents for the Croatia Digital Nomad Visa

This permit is designed specifically for non-EU remote professionals working online for non-Croatian employers or clients.

All documents must be submitted in Croatian or English.

Documents issued in other languages must be translated by an authorised translator.

1. Valid Passport

- Copy of a valid travel document

- Must be valid at least 3 months beyond your intended stay

This is a basic but mandatory Croatia digital nomad visa requirement.

2. Proof of Purpose (Remote Work)

One of the most critical Croatia digital nomad visa requirements is proving that your work is genuinely remote. You must show

- Your work is performed online, and

- Your employer or business is registered outside Croatia, and

- You provide no services to Croatian clients or companies

Accepted documents include:

If you’re employed

- Employment contract and/or

- Employer letter confirming:

- Remote work arrangement

- Company registered outside Croatia

- No Croatian clients or operational presence

If you’re self-employed or a business owner

- Proof of registration of your foreign company

- Evidence that you perform work through that company remotely

This is the most common bottleneck.

Contracts that prove employment but don’t explicitly say “remote work” often trigger follow-ups.

This is the most common bottleneck in meeting the Croatia digital nomad visa requirement. Contracts that prove employment but don’t explicitly say “remote work” often trigger follow-up requests

3. Proof of Means of Subsistence (Income or Savings)

You must prove financial self-sufficiency under Croatian regulations.

Minimum income requirement (2025/26):

- €3,295 per month, calculated as 2.5× the Croatian average net salary

This amount increases by +10% per dependent.

You may submit one of the following:

- Bank statements showing regular monthly income

- Payslips for the last 6 months

- Bank statement showing the full amount available upfront

Savings alternative:

- €39,540 for a 12-month stay

- €59,310 for an 18-month stay

All financial documents must:

- Clearly state the currency

- Be submitted as PDF files (max size: 2MB)

- Show consistent availability (not last-minute deposits)

4. Proof of Health Insurance

- Private or travel health insurance is acceptable

- Must explicitly cover the territory of Croatia

- Must cover your entire intended stay

Policies that say “worldwide except…” without naming Croatia often cause delays.

5. Proof of Accommodation in Croatia

You must provide an address in Croatia to determine the competent police administration (MUP).

Accepted proof includes:

- Rental agreement (Ugovor o najmu)

- Property ownership document

- Confirmed hotel, hostel, or short-term accommodation booking (for first-time applicants)

Placeholder or unverifiable bookings are frequently rejected.

Q: Do I need to book accommodation for the full duration when applying for the Croatia Digital Nomad visa?

A: There is no official requirement to prove accommodation for the full length of your stay at the application stage. A temporary address, such as a hotel or Airbnb booking, is generally sufficient for the online application form. However, once you arrive in Croatia, you must register your actual address with the police within 3 days of arrival. At that point, you’ll need proper documentation for where you are staying (e.g. landlord statement, lease, or accommodation confirmation).

In short: temporary address for the application is fine, formal address registration happens after arrival.

6. Criminal Background Check

As part of the Croatia digital nomad visa requirement, you must submit a criminal background check:

- Issued by your country of citizenship, or

- A country where you have resided for more than one year before arrival

- Must be:

- Apostilled or legalised

- Translated into Croatian or English (if applicable)

This document is mandatory for initial applications and treated as a public-order requirement.

7. Application Essentials

- Completed Form 1a (if applying in person) or online submission

- Passport photo(s)

- Administrative fee payment

- Statement explaining the purpose of stay and why you chose Croatia

Where and How to apply for Croatia digital nomad visa

For further detail, check out this guide on How to apply for Croatia digital nomad visa.

You may apply:

- Online via the Croatian government portal

- At a Croatian embassy/consulate

- At local MUP if already in Croatia

If you are submitting your application in person, you have to fill in Form 1a (bilingual form)

Final decisions are issued by the Croatian Ministry of the Interior, not embassies or visa centers.

Embassies and VFS only:

- Collect documents

- Capture biometrics

- Forward applications

This means local interpretation by the assigned police administration matters.

Applying from the United States

US citizens can apply:

- At a Croatian consulate in the US

- Online via the government portal

- At MUP after entering Croatia visa-free

I’m a U.S. citizen based in Los Angeles, so I entered Croatia visa-free for 90 days and applied early for digital nomad residence at the local police administration (MUP). Applying in Croatia meant I didn’t need a Visa D. After my application was approved, I paid the required fees by internet banking: €46.45 for temporary stay approval, €9.29 in administrative fees, and €31.85 for the biometric residence card

– Alex Turner, Product designer freelancer

What’s Different for US Applicants

US citizens face more document formalities, especially:

- FBI background checks (not state-level)

- Apostille via the US Department of State

- Employer letters often reviewed more closely

U.S. applicants are strongly advised to start the FBI background check process before traveling, as processing times can easily exceed initial expectations. Employer confirmation letters should be carefully reviewed to ensure they align with Croatian legal requirements, rather than standard U.S. HR templates, which often lack the necessary wording on remote work status and employer location. Many U.S. applicants also underestimate the time required for certified translations and apostilles. In practice, delays at this stage are one of the most common reasons otherwise eligible digital nomad applications become stalled.

Applying from the UK: What’s Different?

If you are applying from the UK, the process is broadly similar to that for U.S. applicants, meaning you can travel to Croatia first and submit your application at the local police administration (MUP).

UK applicants should be aware of a few practical differences. Fees may vary slightly depending on where you apply, particularly between consulates such as London and Manchester or Edinburgh. In addition, criminal background checks are typically issued through an ACRO Police Certificate, which is the standard document accepted for Croatian digital nomad applications.

Applying from Asia (Countries Without 90-Day Visa-Free Entry)

Applicants from countries that do not have visa-free entry to Croatia such as Vietnam, China, India, Thailand, and others follow a more complex process. Unlike U.S. or UK citizens, you cannot travel to Croatia first and apply on arrival.

Application process for Countries Without 90-Day Croatia Visa-Free Entry

- Submit your digital nomad residence application online through the MUP system or at the nearest Croatian embassy or consulate (often via regional locations such as Jakarta or Malaysia, or through a VFS visa center).

- After temporary residence is approved, you must apply separately for a long-term Visa D to enter Croatia.

- Upon arrival in Croatia, you report to the local police administration (MUP) to complete registration and obtain your biometric residence card.

This route is more expensive, with total fees typically around €190, primarily due to the additional Visa D requirement. Processing timelines can also be longer, as approval of temporary residence and issuance of the Visa D occur in separate stages.

Extension Rules

- Maximum stay: 18 months

- One extension only

- Mandatory 90-day exit after expiry

- No PR or citizenship pathway

Despite online claims, Croatia does not offer:

- 3-year continuous DN status

- Automatic conversion to work permits

- Residence counting toward PR

Planning around this early avoids overstaying risks.

Croatia digital nomad visa Processing time and Fees

Overview

- Processing time: up to 60 days

- Fees: approx. €100-€150

- Additional costs:

- Insurance

- Apostilles

- Certified translations

The Reality of Processing Times: While some people do wait 5-6 months, the official target for a decision is usually 30 to 60 days.

Croatia Digital Nomad Permit Fees Breakdown

Fees depend on where you submit your application.

If you apply at a Croatian embassy / consulate abroad

(Fees are paid at the time of application)

- €55.74 – temporary stay approval

- Either

- €93.00 – long-term visa (Visa D), or

- €41.14 – biometric residence card (availability depends on the consulate)

If applying through a VFS visa center, an additional service fee may apply.

If you apply at a police administration / police station in Croatia

(Fees are paid after the stay is approved)

- €46.45 – temporary stay approval

- €9.29 – administrative fee

- €31.85 – biometric residence card

- €59.73 if using the accelerated procedure

Why Some Applications Take Longer

Delays usually come from:

- Income clarification requests

- Employer letter revisions

- Apostille verification

- Accommodation inconsistencies

Not from quotas or caps.

Taxes for Digital Nomads (Clarified)

Overview

- No Croatian tax on foreign income

- Home-country tax rules still apply

Croatia does not tax income sourced outside Croatia for digital nomad permit holders.

However:

- Tax residency elsewhere may still apply

- The US taxes citizens globally regardless of residence

This is where applicants confuse immigration status with tax residency.

Official Sources for Croatia Digital Nomad Visa Requirements

All core requirements below are based on guidance from:

- Croatian Ministry of the Interior (MUP) — residence permits and eligibility

- Croatian Bureau of Statistics (DZS) — income threshold calculation

- Ministry of Foreign and European Affairs of Croatia — consular procedures

- VFS Global — biometric submission in select countries

These are the same sources immigration officers rely on, which is why formatting and interpretation matter as much as eligibility.

How We Help Digital Nomads Apply the Right Way

At Mandracchio Capital, we work with digital nomads who value certainty over shortcuts. Our role isn’t to push applications through blindly, it’s to make sure your case is structured correctly from the start.

We operate at the intersection of EU immigration law, tax positioning, and document compliance, and we work directly with vetted local lawyers across Croatia. That means you’re not relying on forum advice or generic templates, but on interpretations that align with how Croatian authorities actually review applications.

In practice, this often comes down to small but critical details: how an employer letter is worded, how income is evidenced over time, or how foreign documents are prepared for Croatian use. These are the areas where most rejections occur, and where experience makes the difference.

If you want clarity before you apply, we offer a free eligibility and document review, no obligation, no sales pressure.

FAQs

Is Croatia’s digital nomad visa open to US citizens?

Yes.

Croatia specifically targets non-EU professionals with foreign income.

Practical tip: US applicants should prepare IRS-style income documentation early.

How long can I stay on the digital nomad visa?

- Total Stay: The maximum continuous stay allowed on a single digital nomad permit cycle is 18 months. If your initial permit was for less than 18 months, the extension can be granted for a maximum of an additional 6 months, provided the total does not exceed the overall limit

- Initial Permit: The permit can be issued for up to 18 months (increased from the previous 12-month limit).

- Extension: It may be extended once for an additional period (up to another 18 months, depending on your initial application).

- Cooling-off Period: After your permit (and any extension) expires, you must leave Croatia for at least 6 months (not 90 days) before you can reapply for a new digital nomad residence permit.

Do I need to pay tax in Croatia?

No, not on foreign income.

The permit explicitly exempts foreign-sourced earnings.

Practical tip: Always confirm obligations in your home country.

How and where can I apply for the Croatia digital nomad permit?

You have three main options:

Applying in Croatia: If you are visa-exempt (e.g. US, UK, Canada), Apply at the local police administration (MUP) after entry.

Applying outside Croatia: Apply at a Croatian embassy or consulate in your home country

Online: An official online application portal is available, Final decisions are still issued by the Ministry of the Interior

What is the acceptance rate for the Croatia digital nomad permit?

Croatia does not publish an official acceptance rate for the digital nomad permit.

In practice, the majority of refusals or delays are not due to ineligibility, but to documentation issues, especially unclear proof of remote work, inconsistent income evidence, or missing apostilles and translations.

Well-prepared applications that clearly demonstrate foreign remote work, sufficient income, and clean documentation are commonly approved.

How do I prove remote work for the Croatia digital nomad permit?

You must prove that you perform work through communication technology for a foreign employer or your own foreign-registered company. Accepted proof includes one or more of the following:

- A signed statement or official letter from your employer confirming:

- You work remotely

- Your employer is registered outside Croatia

- No services are provided to Croatian entities

- A contract of employment or service contract with a foreign employer

- If you are self-employed or a business owner:

- A copy of your company’s registration (tax authority or business court), and

- Evidence that you perform work through your own company using communication technology