If you’re a foreigner looking to start a business in Croatia, the first thing to know is this: Croatia has its own system.

The LLC equivalents here are usually a d.o.o. (limited liability company) or j.d.o.o. (simple LLC) and the “best choice” depends on your budget, credibility needs, and whether you’re planning to operate locally or use Croatia as an EU base.

In this article, you’ll learn the main company types, what you need to prepare, and how the registration process works from name reservation to court registration and getting your business ready to operate.

Key Takeaways – Starting a d.o.o. (LLC) in Croatia

- To form a Croatian LLC (d.o.o.), you’ll need notarized founding documents (Articles of Association or a Founder’s Declaration), plus a registered Croatian business address.

- You must obtain an OIB (Croatian tax ID) for founders/directors before key registration steps can be completed.

- Share capital must be deposited into a temporary account (often via a bank or FINA), and proof of payment is required for court registration.

- The company becomes legally active only after registration in the Commercial Court / Court Register and issuance of the company’s OIB.

- After incorporation, you must complete post-registration steps such as NKD classification (CBS/DZS), bank account setup, and registrations with Tax Administration, HZMO (pension), and HZZO (health) where applicable.

- Croatian citizens may use streamlined options like START, while foreign founders typically register through a notary/lawyer and physical filings.

How to Start an LLC in Croatia (d.o.o.)

To start an LLC (d.o.o.) in Croatia, you must complete a defined legal sequence. At a high level, the process includes preparing a notarized founding document (Articles of Association or a Declaration of Incorporation), depositing the required share capital, opening a corporate bank account, and registering the company with the Commercial Court (Trade Register).

Every founder must obtain an OIB (Croatian tax ID), and the company must be registered for taxes and, where applicable, VAT. After incorporation, the company must also be registered with the Croatian Pension Fund (HZMO) and Health Insurance Fund (HZZO), especially if the founder or employees will work in Croatia. Certain activities require additional licenses or approvals.

Digital Setup (START System)

- For Citizens: Croatian citizens can use the integrated online START system (e-Građani portal) for faster setup.

- For EU Citizens: EU citizens can potentially use the E-Court Register with their home country credentials.

Most foreign founders instead rely on a local notary or legal representative to handle incorporation correctly.

For a detailed, step-by-step explanation of the process, timelines, and fees, please read: Step by Step Process to Register a Company in Croatia

Required documents to start a company in Croatia for Foreigner

We’ve prepared this dedicated guide with the full list of requirements (in detail) for both EU and non-EU: founders List of documents required to start a company in Croatia

How to Start an LLC in Croatia: d.o.o. vs. j.d.o.o.

If you want to start an LLC in Croatia, your first real decision is not paperwork, it’s structure.

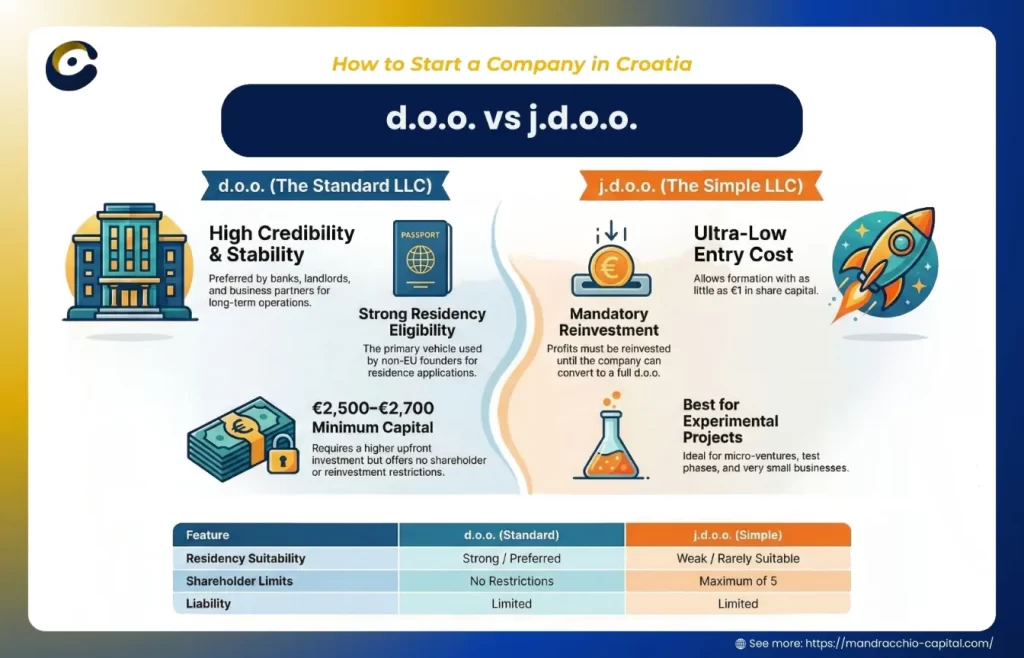

Most founders choose between d.o.o. (standard limited liability company) and j.d.o.o. (simplified limited liability company).

Both are legal. Both limit personal liability.

But they are not interchangeable, especially for foreign founders.

This guide focuses on how to choose the right structure, not how to file forms.

The Core Difference (In Plain Terms)

A d.o.o. is Croatia’s standard, fully recognized limited liability company. It is designed for businesses that intend to operate seriously, interact with banks and partners, hire staff, or exist long-term.

A j.d.o.o. is a simplified version created to lower the entry barrier for very small businesses. It reduces upfront requirements but introduces structural limits that can become restrictive once the business grows or becomes more complex.

The most common mistake founders make is choosing a j.d.o.o. because it feels faster or cheaper at the start then discovering it no longer fits once real operations begin.

Comparison Table: d.o.o. vs. j.d.o.o.

| Feature | d.o.o. (Limited Liability Company) | j.d.o.o. (Simple Limited Liability Company) |

|---|---|---|

| Purpose | Suitable for small and medium-sized businesses; widely used by foreign investors | Designed for start-ups and very small businesses seeking low-cost entry |

| Minimum Share Capital | €2,500–€2,700 | €1 |

| Credibility | High, preferred by banks, landlords, and business partners | Moderate, often viewed as temporary or entry-level |

| Residency Eligibility | Strong, commonly used by non-EU founders; higher capital often required in practice | Weak, rarely suitable for residence applications |

| Special Capital Requirements (Non-EU/EEA) | Non-EU founders may need higher capital in practice when using a d.o.o. for residence | Low-cost entry, but generally unsuitable for residence pathways |

| Liability | Limited liability, personal assets protected up to invested capital | Limited liability |

| Shareholder Limits | No restrictions | Maximum of 5 shareholders |

| Reinvestment Obligation | No reinvestment requirement | Mandatory reinvestment of profits until conversion to d.o.o. is possible |

| Formation Process | Notary procedures and full legal steps required | Simplified formation with reduced capital |

| Accounting | Accounting services required | Accounting services required |

| Best For | Foreign investors, relocations, and long-term business operations | Small experimental projects, micro-ventures, test-phase activities |

If you are a non-EU founder, this comparison alone usually answers the question. Croatian banks, authorities, and partners expect a d.o.o. in cross-border cases.

When a j.d.o.o. Can Make Sense

A j.d.o.o. works only in narrow situations. It is suitable when the business is intentionally small and simple, and when you are comfortable with structural limits.

A j.d.o.o. can make sense if you are testing a very small idea with minimal risk, no or very limited staff, and no plans for residency or external financing. These businesses are usually low-liability, low-volume, and often local or online.

When a d.o.o. Is the Correct Choice (Most Cases)

A d.o.o. is the right structure in most real-world scenarios. It is built for businesses that interact with the market in a visible, regulated, or scalable way.

You should choose a d.o.o. if you are a foreign founder, plan to live in Croatia, need a lease or permits, intend to hire staff, or want credibility with banks, suppliers, and partners. It is also the correct choice if you want the business to grow or remain active long-term.

Answering Your Questions on Choosing the Right Company Type

Sophie M. (France):

“I want to open a spa and wellness studio with local clients. Does the company structure really matter?”

Mandracchio Capital: Hi Sophie. Any business with a physical location, employees, inspections, or local permits is best structured as a d.o.o.. It provides a clear framework for leases, staff contracts, regulatory compliance, and ongoing operations. Simpler structures tend to create complications in practice.

Laura S. (Canada):

“I want to open a small café and bakery in a coastal town. I’ll need a lease and a few local employees. Is a j.d.o.o. enough?”

Mandracchio Capital:

Hello Laura. For hospitality businesses involving a physical space, staff, food safety inspections, and lease agreements, a d.o.o. is the correct structure. Banks, landlords, and inspectors expect it. A j.d.o.o. tends to create friction in regulated, customer-facing operations like cafés or bakeries.

Thomas W. (Australia):

“I run an online consulting business and don’t plan to hire staff right away. I may relocate later. Should I start small?”

Mandracchio Capital:

Hi Thomas. If relocation is even a future possibility, a d.o.o. is usually the better starting point. While a j.d.o.o. may work short term, it often becomes limiting once residency planning, banking, or EU credibility come into play.

Anya K. (Germany):

“I want to buy a small company in Croatia and expand it over time. Does the structure matter if the business already exists?”

Mandracchio Capital:

Yes, it still matters. Acquisitions and expansion strategies work best within a d.o.o. structure because it offers clearer governance, stronger credibility with lenders, and flexibility for future ownership or management changes.

Michael J. (United States):

“I want to open a company mainly to support my residence in Croatia. Which structure is safer?”

Mandracchio Capital:

For residence-linked cases, a d.o.o. is strongly preferred in practice. Authorities expect a standard limited liability company that shows real economic activity and compliance. A j.d.o.o. is rarely suitable for long-term residence planning.

Elena P. (Spain):

“I’m testing a small creative project with no employees and low turnover. I’m not sure it will grow.”

Mandracchio Capital:

In that scenario, a j.d.o.o. can work as a short-term testing structure, as long as you understand its limits. If the project grows or becomes operational, converting to a d.o.o. later is common.

Have a question? Send it to us via the contact form/ email below. We update this section weekly.

Have a specific situation?

If your case involves residency planning, company structure, or cross-border considerations, you can book a consultation with our team to review your situation in detail.

FAQ – How to Start an LLC in Croatia

Can I open an LLC (d.o.o.) in Croatia and then apply for citizenship?

No, opening a Croatian LLC (d.o.o.) does not directly lead to Croatian citizenship. Citizenship is a separate process governed by Croatian nationality law.

Croatian citizenship is granted only under specific legal grounds (such as descent, marriage, naturalization, or special interest). Business ownership alone is not a shortcut to citizenship.

To understand who qualifies for Croatian citizenship and under which legal articles, see our full guide here: How to Get Croatian Citizenship

What is the main difference between a d.o.o. and a j.d.o.o.?

Both are limited liability companies under Croatian law, meaning personal assets are protected. The difference is practical, not legal. A d.o.o. is the standard, fully recognized LLC designed for long-term operations, credibility, and growth. A j.d.o.o. is a simplified version intended for very small, early-stage projects and comes with structural limits that often become restrictive for foreign founders.

Are d.o.o. and j.d.o.o. interchangeable later?

Not easily. While a j.d.o.o. can be converted into a d.o.o., the process takes time, requires retained profits, and adds legal and accounting steps. Many founders end up restructuring later, which is why choosing the right structure at the start matters.

Which structure is better for foreign founders?

In practice, a d.o.o. is almost always the better choice for foreign founders, especially non-EU nationals. Banks, landlords, authorities, and business partners expect a d.o.o. in cross-border cases. A j.d.o.o. is rarely suitable for residency planning or long-term operations.

What do I need to start an LLC (d.o.o.) in Croatia?

To start an LLC (d.o.o.) in Croatia, you must follow a defined legal sequence. At a high level, this includes preparing a notarized founding document (Articles of Association or a Declaration of Incorporation), depositing the required share capital, opening a corporate bank account, and registering the company with the Commercial Court (Trade Register).

Every founder must obtain an OIB (Croatian tax ID). After incorporation, the company must be registered for taxes, and where applicable VAT, as well as with the Croatian Pension Fund (HZMO) and Health Insurance Fund (HZZO) especially if the founder or employees will work in Croatia. Some activities also require sector-specific licenses or approvals.

Can I start an LLC in Croatia online?

It depends on your citizenship.

Croatian citizens can use the START system (e-Građani portal) for a fully digital setup. Some EU citizens may use the e-Court Register. Most foreign founders, especially non-EU nationals, rely on a local notary or legal representative to complete the process correctly.

What documents are required for foreigners to start a company in Croatia?

Foreign founders typically need identification documents, notarized and translated founding documents, proof of address, and documents required to obtain an OIB. Requirements can vary depending on nationality and whether the founder applies remotely or in person.

For a complete breakdown, see: List of Documents Required to Start a Company in Croatia for Foreigners.

How to open an LLC in Croatia?

To open an LLC in Croatia (a d.o.o.), you must prepare a notarized founding document, deposit the required share capital, obtain an OIB (Croatian tax ID), register the company with the Commercial Court (Trade Register), open a corporate bank account, and register for taxes, pension (HZMO), and health insurance (HZZO). Croatian citizens may use the online START system, while most foreign founders work through a notary or legal representative.

Can I invest in Croatia through a company, and how should it be structured?

Yes, many foreign investors use Croatian companies to invest in businesses, real estate, or long-term projects. However, how the company is structured matters far more than simply forming one. The wrong setup can lead to residency issues, tax inefficiencies, compliance delays, or weak asset protection, especially when investment and residence planning are not aligned from the start.

If your goal involves residency by investment, property acquisition, or capital deployment in Croatia, structure comes before execution.

Explore our Investor Services to structure your investment entity correctly.

What is the LLC equivalent in Croatia?

The Croatian equivalent of an LLC is a d.o.o. (društvo s ograničenom odgovornošću). It offers limited liability protection, allows full foreign ownership, and is the most commonly used structure for both local and international businesses.

Can a foreigner start a business in Croatia?

Yes. Foreign nationals, including non-EU citizens, can own 100% of a Croatian company without restriction. However, business ownership alone does not grant the right to live or work in Croatia. Residency and work permissions must be obtained separately and structured correctly, especially for non-EU founders.

How can I set up a company in Croatia without hidden legal or tax risks?

Many foreign founders register a company but overlook compliance sequencing, liability exposure, or tax classification from day one. These issues often surface later, when fixing them is costly. Get my company registered and operational the right way here.