Key Takeaways for Croatia Digital Nomad Visa

- Valid 18 months; not allowed to work for Croatian employers or clients.

- Income requirement ~€3,295/month + proof of health insurance + clean criminal record.

- Apply online, at an embassy, or at local police, processing ~6–10 weeks.

- Even if you stay in Croatia for 183 days or more during the year with this visa, you will not become a tax resident..

- Professional support ensures smooth paperwork + optimal tax structure, especially for long stays.

Croatia Is on Every Digital Nomad’s Radar ( and It Ranks Among the Top 3 Digital Nomad Tax-Free Countries in Europe & Beyond)

Fast Wi-Fi by the Adriatic, coffee breaks in UNESCO-listed cities, and lower living costs than Western Europe make Croatia an increasingly popular base for non-EU digital nomads from the US, UK, Canada, Australia, New Zealand, and other countries.

Since 2021, Croatia has officially welcomed remote professionals through its Digital Nomad Residence Permit, often called the “digital nomad visa.” While it’s not technically a visa, it allows eligible third-country nationals to live and work remotely from Croatia for up to 18 months (and potentially longer under updated rules).

Let’s break down exactly how it works, what it costs.

What Is the Croatia Digital Nomad Visa?

The Croatia Digital Nomad Visa is a temporary residence permit designed specifically for non-EU/EEA nationals, including citizens of the US, UK, Canada, Australia, New Zealand, and other third countries, who work remotely for:

- a foreign employer, or

- their own company registered abroad

This permit is designed for remote workers, freelancers, consultants, and entrepreneurs whose clients are outside Croatia.

- Stay up to 12–18 months

- Work remotely for a non-Croatian company

- Bring your family (family reunification)

- Not allowed: work for Croatian companies or serve Croatian clients

If you’re from the EU/EEA, you do not need this permit due to EU freedom of movement.

Although commonly called a “digital nomad visa,” Croatia legally treats this status as a temporary residence permit, not a visa. Under Croatian law, visas apply to short-term entry, while living in Croatia long-term requires a residence permit issued under the Law on Foreigners.

Croatian law also requires a six-month break after the Digital Nomad residence expires before the same permit can be granted again. This break interrupts continuous residence, which is why time spent exclusively on a Digital Nomad permit does not create a direct path to permanent residence.

Lowest Tax Countries for Digital Nomads

One of the reasons many digital nomads choose Croatia is its tax environment. While the Digital Nomad Visa itself does not automatically exempt holders from all tax obligations, Croatia generally offers competitive tax conditions for remote workers, especially those who maintain tax residence outside the country or stay under the 183-day threshold. For a deeper look at how digital nomads are taxed in Croatia and how it compares with other European destinations, see our article on tax considerations for digital nomads in Croatia: How do taxes work for digital nomads (croatia digital nomad tax)?

Tax Treatment for Digital Nomads in Croatia (Important Clarification)

Croatia provides a specific income tax exemption for qualifying digital nomads on working income earned from foreign employers or businesses, based on their approved digital nomad status.

This exemption:

- Applies only to active working income

- Does not automatically exempt passive income (such as rentals, dividends, or capital gains)

- Does not remove tax reporting obligations in your home country

The 183-day mark is important for general tax residency, but the Digital Nomad Visa creates a special pathway, letting you legally reside in Croatia longer without paying Croatian income tax on your remote earnings

Who the Croatia Digital Nomad Visa Is NOT For

The Croatia Digital Nomad Visa is an excellent option for many remote workers—but it is not suitable for everyone.

This permit is not designed for:

- Individuals planning to work for Croatian companies or clients

- Freelancers intending to invoice Croatian businesses

- Applicants seeking a direct or automatic path to permanent residence or citizenship

- Those with unstable or insufficient income

- Individuals who want access to Croatia’s public healthcare system (HZZO) from day one

Understanding these limits early helps avoid wasted time and ensures you choose the right residence strategy from the start.

Eligibility Requirements for Croatia Digital Nomad Visa

To qualify, you must:

- Be a non-EU/EEA citizen (including US, UK, Canada, Australia, New Zealand, etc. Source: https://mup.gov.hr/)

- Work remotely for a foreign employer or business registered abroad

- Earn ~3,295€/ month (As of May 2025)

- Have valid health insurance

- Have a clean criminal background

- Provide proof of accommodation (rental contract, hotel, deed)

Our tip: Submitting documents translated into Croatian can speed up approval.

For full requirements and eligibility criteria, refer to our Croatia digital nomad visa requirements guide.

Proof of Income Requirements

Applicants must show stable income from a non-Croatian employer or foreign-registered business. The general requirement is around €3,295 per month, though proof must be clear, consistent, and well-documented. Bank statements are the most common proof, but contracts, invoices, and company ownership documents also help strengthen the application. Croatian authorities look for financial stability, not just a single high-income month. Many applicants prefer submitting three to six months of bank statements to show consistent earnings. If income varies monthly, you may support your case with savings or annual contracts. Clear documentation speeds up approval and helps avoid back-and-forth with the police station (MUP).

Health Insurance for Digital Nomads

Digital nomads must have private international health insurance valid in Croatia for the full duration of their stay. Because the Digital Nomad Visa doesn’t grant access to the national health system (HZZO), public insurance is not required nor offered. Insurance should clearly show coverage for Croatia, including emergency treatment and hospitalization. Many applicants choose global plans like Allianz, Cigna, or SafetyWing because they include multi-country travel. Proof of coverage must be submitted during the application and presented again when registering your address. Ensuring your policy includes Croatia helps avoid delays at the police station. If you plan to stay long-term, switching to HZZO later becomes possible only under a different residency permit.

Why Choose Croatia as a Digital Nomad Base?

Croatia offers a strong mix of lifestyle quality, safety, and practical infrastructure for high-earning digital nomads. Its Mediterranean setting, reliable high-speed internet, and lower day-to-day costs compared to much of Western Europe make it an attractive European base without the trade-offs.

The country is consistently regarded as safe and easy to live in, with established expat communities and a growing coworking ecosystem in cities like Zagreb, Split, and Zadar. Depending on personal structure and tax residency, foreign-sourced income earners may also benefit from favorable tax outcomes.

If you’re deciding which city fits your lifestyle and priorities, explore our guide to the best cities to live in Croatia, with practical insights on the pros, cons, and realities of each location.

Croatia Digital Nomad Visa vs Other EU Options

Many digital nomads compare Croatia with other popular European destinations offering remote-work residence options. While each country has its appeal, Croatia stands out for its clarity, predictability, and lifestyle balance.

Croatia vs Portugal

- Duration: Up to 18 months (Portugal often requires renewals)

- Tax clarity: Clear exemption for qualifying digital nomad working income

- Path to PR: Not direct, but easy to transition to other residence types

- Cost & bureaucracy: Lower living costs, simpler procedures

Croatia vs Spain

Cost & bureaucracy: Higher administrative burden, especially in major cities

Duration: Typically 12 months

Tax clarity: Spain applies specific tax regimes that can be complex

Path to PR: Possible, but with higher compliance and tax exposure

Croatia digital nomad visa Application process

Digital nomads working for non-Croatian employers are generally exempt from local income tax and can enjoy free travel across the Schengen Area while living affordably in a vibrant Mediterranean setting. With continued residence of up to five years potentially leading toward permanent residency and even citizenship, the visa offers a flexible path to experience Croatia while maintaining a remote career abroad.

Application Timeline (Typical)

- Week 1–2: Document preparation, apostilles, translations

- Week 3: Application submission (online, embassy/consulate, or local police station)

- Week 4–8: Review by the Ministry of Interior (MUP), possible follow-up requests

- Week 8+: Approval, address registration, and biometric residence card issuance

Administrative Steps After Submission

Once your application is filed, the process typically follows this sequence:

- Application submission

- Online, at a Croatian embassy/consulate, or at a local police station (MUP)

- Forms & documentation review

- Standard forms such as Obrazac 1a (application) and later Obrazac 16a (address registration)

- Officers may request additional documents or translations

- Approval decision

- Notification by email, phone, or post

- Address registration

- Temporary address first, then long-term accommodation within statutory deadlines

- Biometric residence card

- Fingerprints, photo, signature

- Card pickup usually within a few weeks

- Administrative fees

- Fees apply for residence approval and biometric card issuance

- Paid either during application (abroad) or after approval (in Croatia)

Processing times vary by location, season, and document clarity. Submitting well-prepared and translated documents often reduces delays.

Thinking of applying? We’ve streamlined it for you. Our How to apply for Croatia digital nomad visa guide walks you through essentials such as gathering proof of income, insurance, and passport details; submitting your application online or via embassy; and completing address registration once approved. You’ll also find tips to avoid delays and understand expected timelines.

For hands-on assistance, explore our Residency (VISA) support for digital nomads and expats page.

Find Your Perfect Base in Croatia - Without the Guesswork

Your research phase should feel clear, not overwhelming. We’ve helped hundreds of readers understand the basics start with the guide that makes everything easier.

Benefits for Non-EU Nationals

Digital nomads from non-EU countries who work exclusively for foreign employers are generally exempt from Croatian income tax, provided they remain under the 183-day threshold and do not generate Croatian-source income.

While the Digital Nomad Visa itself does not lead directly to permanent residency, it offers non-EU nationals a flexible way to test life in Croatia. Many later transition into other residence categories -such as business ownership or employment-once they decide to stay longer.

Digital Nomad Visa vs Temporary Residency

The Croatia Digital Nomad Visa is a special temporary residence permit created specifically for remote workers employed by foreign companies. It does not allow employment in Croatia and cannot convert directly into long-term residency. Temporary Residency, on the other hand, covers a wider range of purposes – work contracts, family reunification, study, business ownership, or long-term stay.

Explore: How to Get Temporary Residency in Croatia

Unlike the Digital Nomad Visa, most Temporary Residency permits can be renewed year after year, creating a pathway to permanent residency after five years. Digital nomads also do not gain access to Croatia’s public health insurance (HZZO), while Temporary Residents usually must register for it. Because the Digital Nomad Visa expires after 12–18 months, many remote workers eventually switch to Temporary Residency options once they decide to stay longer. Understanding the difference helps applicants plan ahead and avoid unexpected limits.

Visa Extension & Renewal Process

The Digital Nomad Visa is typically granted for 12 months, with some applicants receiving up to 18 months depending on documentation. After expiration, you must leave Croatia for six months before applying again, as the visa is not designed for continuous long-term residency. Some digital nomads extend their stay by switching to another type of Temporary Residency, such as work, family reunification, or company ownership. Extensions must be filed at least 30 days before your permit expires. The process includes updated proof of income, insurance, and address. While the renewal rules are strict, good planning allows digital nomads to maintain long-term presence in Croatia legally. Many who wish to stay beyond the limit explore alternative residency pathways.

Is the Digital Nomad Permit a Path to Permanent Residence?

The Digital Nomad permit is a great trial year or up to 18 months to experience life in Croatia, but it is not designed as a direct permanent residence route.

Because the permit requires a mandatory break between applications, it does not allow for uninterrupted residence. Many digital nomads who decide to stay longer later transition into other temporary residence categories such as business ownership, employment, or family reunification that can be renewed annually and count toward permanent residence.

Summary: Croatia Digital Nomad Visa at a Glance

| Aspect | Details |

|---|---|

| Type | Temporary residence permit |

| Eligibility | Non-EU/EEA citizens |

| Work Allowed | Remote work for foreign employer or clients |

| Duration | Up to 18 months |

| Taxes | Generally exempt |

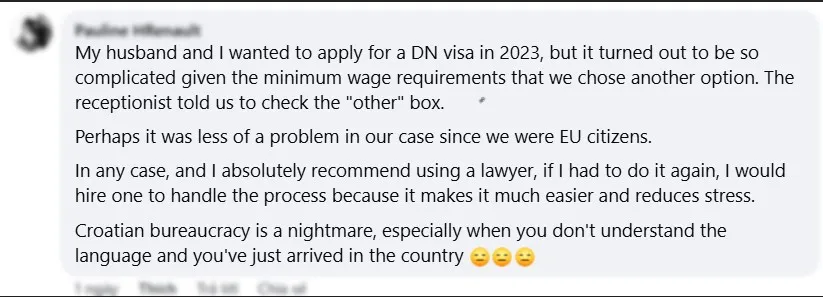

Do You Need Legal Support for the Croatia Digital Nomad Visa?

Strictly speaking, you don’t need a lawyer to apply for the Croatia Digital Nomad Visa. Many applicants successfully submit their applications on their own. That said, a large number of our clients come to us after experiencing delays, unclear instructions, or inconsistent guidance particularly in non-standard situations such as:

- Family applications or dependents

- Income structures that don’t fit neatly into templates

- Applications filed shortly after arrival

- Communication challenges at local police stations (MUP)

In these cases, professional support often means faster processing, clearer expectations, and far less stress. We help ensure documents are prepared correctly, translated where needed, and presented in a way that aligns with how authorities actually review applications in practice.

About Mandracchio Capital

At Mandracchio Capital, we help expats navigate Croatia’s residency and relocation system with clarity and dependable local guidance. Whether you’re applying for the Croatia digital nomad visa, planning to retire in Croatia, or simply exploring life as one of the growing expats in Croatia, we simplify requirements, prepare your documentation, and keep every step compliant – so you avoid delays and uncertainty and move forward with confidence in your new life in Croatia.

FAQs

Is the Digital Nomad Visa for EU citizens?

EU/EEA citizens don’t need the Croatia Digital Nomad Visa because they already have freedom of movement within the EU.

How long can I stay?

The maximum continuous stay allowed on a single digital nomad permit cycle is 18 months. If your initial permit was for less than 18 months, the extension can be granted for a maximum of an additional 6 months, provided the total does not exceed the overall limit.

After the permit expires, you cannot immediately apply again. You must leave Croatia and the Schengen Area and wait at least 6 months before submitting a new application (which also requires spending 90 days outside Schengen).

Do digital nomads pay Croatian tax?

No, digital nomads with the digital nomad visa will not owe taxes in Croatia. This tax benefit is only valid for those with the digital nomad visa.

Can I work for Croatian clients?

No. The permit only allows remote work for non-Croatian employers or businesses.

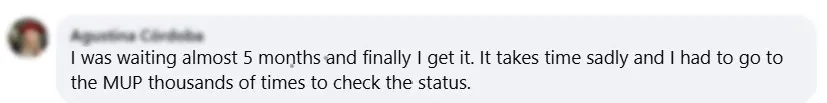

How long does the Croatia Digital Nomad Visa application process take?

In practice, the processing time usually ranges from 3 to 8 weeks, depending on where and how you apply. Processing time can vary based on The completeness and clarity of your documents, Whether translations into Croatian are required, The local police station (MUP) handling the case, The time of year (summer months are often slower).

Can I apply Croatia digital nomad visa on the basis of Fiverr income?

Yes, as long as your income from platforms such as Fiverr, Upwork, or similar freelance marketplaces meets the official requirements for the Croatia Digital Nomad Visa. The rules focus on proof of sufficient foreign-sourced income and genuine remote work status, not on the specific platform through which the income is earned.

Can my family join?

Yes. Your spouse and children may join through family reunification.

Does having a spouse mean I need to double “€3,295 per month” amount?

No, the income requirement does not double; it increases by 10% for each family member.

- Base Income Requirement (Main Applicant): €3,295

- Spousal/Dependent Addition (10% Increase): €329.5

(According to MUP site, “This amount [the base income] is increased by 10% of the average monthly net salary for each additional family member or life partner or informal life partner” )

For situations not covered here or for follow-up questions, our contact form is available if you need further clarification.

Do I need to book accommodation for the full duration when applying for the Croatia Digital Nomad visa?

There is no official requirement to prove accommodation for the full length of your stay at the application stage. A temporary address, such as a hotel or Airbnb booking, is generally sufficient for the online application form. However, once you arrive in Croatia, you must register your actual address with the police within 3 days of arrival. At that point, you’ll need proper documentation for where you are staying (e.g. landlord statement, lease, or accommodation confirmation). In short: temporary address for the application is fine, formal address registration happens after arrival.

Can I leave Croatia while my Digital Nomad permit is pending if my family has overstayed their Schengen stay?

This situation is legally sensitive. In general, overstaying the Schengen tourist limit (90/180 days) is a violation, even if a Digital Nomad residence application is in progress. Pending applications do not automatically legalize an overstay, especially for family members who have not yet applied for family reunification or do not hold written confirmation from MUP. When leaving Croatia in this scenario, border authorities may flag the overstay, which can result in questioning, administrative fines, entry bans, or complications for future visas or residence permits. If you are in this situation, it is strongly recommended to consult MUP or a qualified immigration advisor before traveling