If you are researching the Croatia pension system or the broader pension system in Croatia, this guide provides a clear legal and practical overview for retirees and expats in 2026 including retirement age, Croatia pension contributions, contribution requirements, Croatia pension tax, and cross-border coordination.

Croatia operates a structured three-pillar model within its broader Croatia social security system. Whether you plan to retire in Croatia, receive a Croatian pension, or retire in Croatia as a foreigner, understanding the regulatory and tax framework is essential for long-term financial planning

Legal Framework of the Croatia Pension System

The pension system in Croatia is governed primarily by:

- Zakon o mirovinskom osiguranju – the core Croatian pension law

- Zakon o obveznim mirovinskim fondovima

- Hrvatski zavod za mirovinsko osiguranje (commonly referred to as HZMO Croatia)

- Hrvatska agencija za nadzor financijskih usluga

The system is mandatory for employees and funded through payroll-based Croatia pension contributions rate mechanisms calculated on gross salary.

Structure of the Croatia Pension System (Three Pillars)

Croatia’s pension model consists of three pillars (stupovi):

First Pillar – Mandatory (15% of Gross Salary)

- Pay-as-you-go (generational solidarity)

- Managed by HZMO

- Funded with 15% of gross salary

- If enrolled only in the first pillar: total Croatia pension contributions rate increases to 20%

This pillar pays current pensioners from current workers’ contributions.

Second Pillar – Mandatory (5% of Gross Salary)

- Individual capitalized savings account

- Managed by private pension funds

- Supervised by HANFA

- Contribution: 5% of gross salary

Employees choose their pension fund. Funds are transferable between providers.

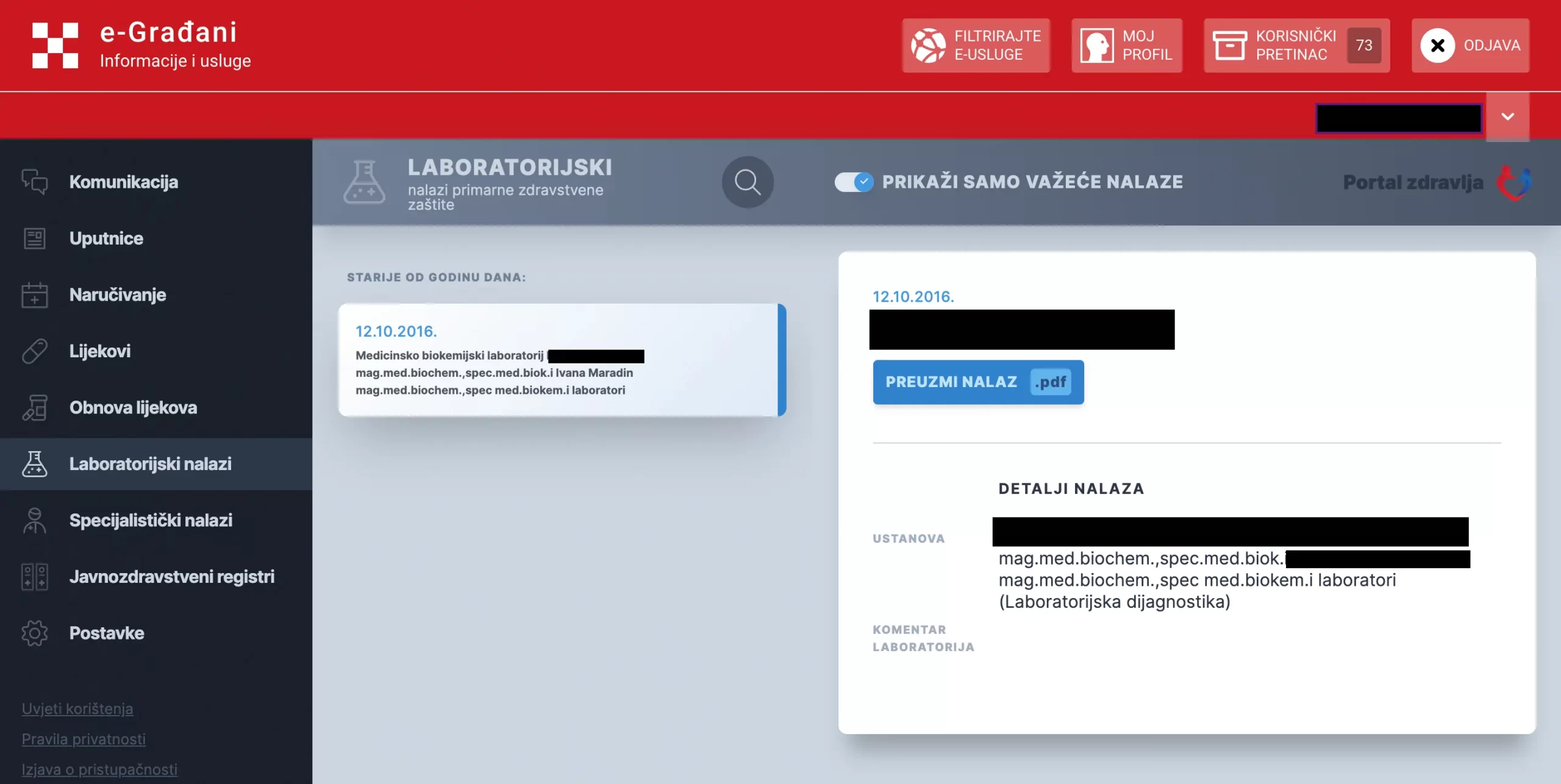

Residents can monitor balances via the REGOS system or through the national digital platform e-Građani.

Third Pillar – Voluntary Pension Savings

- Optional

- Managed by private banks and insurance companies

- Investment-based (stocks, bonds, deposits)

- Eligible for state incentive up to 15% annually (capped)

Withdrawals:

- Age 55 (if enrolled after Jan 1, 2019)

- Age 50 (if enrolled before Jan 1, 2019)

Important: The third pillar is independent from retirement eligibility in pillars one and two.

Retirement Age in Croatia (2026 Overview)

Standard Retirement (Starosna mirovina)

- Men: 65 years

- Women (2025): 63 years and 9 months

- Women’s retirement age gradually increases to 65 by 2030

- Minimum contribution period: 15 years

Early Retirement (Prijevremena starosna mirovina)

- Minimum age: 60

- Minimum service: 35 years

- Pension reduced until age 70 (penalty removed afterward)

Long-Term Insurance Retirement

- Age 60

- 41 years of contributions

Croatia Pension Contributions and Calculation

The Croatia pension contributions system is structured at:

- 15% first pillar

- 5% second pillar

- Total standard rate: 20% of gross salary

Pension amounts are calculated using:

- Personal salary points

- Pension factor

- Current pension value

- Total years of service (radni staž)

Minimum qualifying period: 15 years of contributions (except disability cases).

Parents receive additional credited service (12 months per child), but this does not count toward the 15-year minimum qualification threshold.

Working While Receiving a Pension

Croatian law allows partial continued work:

- Pensioners aged 65+ may work full-time and receive 50% of pension

- Under 65: limited part-time options

- Disability pensioners: restricted employment depending on medical assessment

Additional contributions during work may increase pension entitlements.

Pension taxation in Croatia (Critical for Foreign Retirees)

Croatia Income Tax on Pension

Understanding Croatia income tax on pension is critical for retirees.

Croatian pensions are subject to:

- Progressive personal income tax

- Municipal surtax

- Possible health insurance obligations

Low pensions may fall below taxable thresholds, but Croatia pension tax applies once income exceeds exemptions.

Tax brackets are progressive. However:

- Low pensions may fall below taxable thresholds

- Double taxation treaties may override domestic taxation

Foreign Pension Taxation in Croatia

One of the most common questions is about taxation of foreign pension in Croatia.

If you relocate to Croatia as a retiree:

- Tax residency typically applies if you reside 183+ days per year

- Croatia taxes worldwide income of tax residents

- Double tax treaties (e.g., Canada, Germany, Austria, US, etc.) may allocate taxing rights

Croatia has extensive bilateral social security coordination agreements that allow aggregation of contribution periods.

Foreign retirees should assess:

- Whether pension remains taxed at source country

- Whether Croatia exempts or credits foreign tax

- Social security coverage implications

Proper structuring is essential to avoid dual taxation exposure. This is particularly important for Croatia pension for expats who rely on income from outside Croatia.

National Benefit for the Elderly (Non-Contributors)

Croatia offers a national allowance for residents:

- Age 65+

- Minimum 10 years continuous residence

- No entitlement to pension

This is not a contributory pension but a social assistance mechanism.

Can Foreigners Retire in Croatia?

Yes. Many individuals retire in Croatia as a foreigner through residence permits based on:

- Financial means

- Property ownership

- Family reunification

- Other lawful grounds

EU citizens face simplified procedures.

Non-EU nationals must demonstrate sufficient income and health insurance coverage.

Cost of Retirement in Croatia

Estimated monthly comfortable budget:

- €1,200 – €2,000 depending on city and lifestyle

- Coastal cities (Split, Dubrovnik) more expensive

- Zagreb and Istria often moderate relative to Western Europe

Healthcare quality is generally high, with mandatory health insurance registration required for residents.

Cross-Border Pension Coordination

Croatia coordinates pension rights with:

- EU/EEA member states (EU Regulation 883/2004)

- Bilateral agreements (e.g., Canada)

Contribution periods in different countries may be aggregated to satisfy minimum eligibility requirements.

Each country typically pays a proportional pension corresponding to insured periods completed there.

Croatia Pension System: Key Takeaways for Retirees

- Three-pillar system (15% + 5% mandatory contributions)

- Retirement age: 65 (women equalized by 2030)

- Minimum contribution: 15 years

- Early retirement possible at 60 with 35 years

- Foreign pensions may be taxable in Croatia if tax resident

- Double tax treaties are critical

- Cross-border contribution aggregation possible

- Voluntary third pillar offers state incentives

Strategic Considerations for Foreign Retirees

Before relocating:

- Confirm tax residency implications.

- Review applicable double tax treaty.

- Assess healthcare registration obligations.

- Structure income streams efficiently.

- Verify pension portability.

Differences Between the Pension System in Croatia and Portugal

Summary: Croatia vs Portugal for Retirees

| Feature | Croatia | Portugal |

|---|---|---|

| System Type | Three-pillar (public + private) | Primarily public PAYG |

| Mandatory Private Savings | Yes | No |

| Standard Retirement Age | 65 | ~66+ (life expectancy linked) |

| Early Retirement | 60 with conditions | Allowed with reductions |

| Pension Tax Incentives | No special regime | NHR (under reform) |

| Contribution Minimum | 15 years | 15 years |

For retirees comparing Southern European destinations, Croatia and Portugal both offer attractive lifestyles — but their pension systems differ structurally, administratively, and tax-wise.

Here is a clear comparison.

Pension Structure

Croatia

- Three-pillar system (two mandatory, one voluntary)

- Contributions: 20% of gross salary (15% first pillar + 5% second pillar)

- Mixed public + private model

- Capitalized individual accounts (second pillar)

Portugal

- Primarily public, pay-as-you-go system

- Managed by Segurança Social

- Funded through employer and employee social contributions (~34.75% combined rate, majority employer-paid)

- No mandatory private second pillar equivalent like Croatia

Key Difference:

Croatia has a structured mandatory private savings component (second pillar). Portugal relies mainly on a state PAYG model.

Retirement Age (2026)

Croatia

- Standard retirement age: 65 (women equalized by 2030)

- Early retirement at 60 with 35+ years of service

- Minimum 15 years of contributions

Portugal

- Standard retirement age: 66 years and 4+ months (adjusted annually based on life expectancy)

- Early retirement possible but subject to sustainability factor reductions

- Minimum 15 years of contributions

Key Difference:

Portugal’s retirement age is dynamically linked to life expectancy. Croatia uses a legislatively fixed threshold (with transitional adjustments).

Pension Calculation

Croatia

- Based on personal points system

- Years of service (radni staž)

- Pension factor and current pension value

- Second pillar depends on accumulated capital

Portugal

- Based on lifetime average earnings

- Contribution record

- Sustainability factor adjustments

- State formula without individualized capital accounts

Key Difference:

Croatia combines a solidarity model with individualized capital savings. Portugal operates predominantly through a centralized earnings-based formula.

Taxation of Pensions

Croatia

- Pension income subject to progressive personal income tax

- Local surtax may apply

- Foreign pensions taxable if tax resident

- Double tax treaties applicable

Portugal

- Portuguese residents taxed on worldwide income

- Historically attractive Non-Habitual Resident (NHR) regime (being restructured)

- Foreign pension taxation depends on treaty allocation and new transitional regimes

Key Difference:

Portugal previously offered stronger tax incentives for foreign retirees under NHR. Croatia does not offer a special pension tax regime but may offer lower overall effective taxation depending on municipality.

Cross-Border Coordination

Both Croatia and Portugal:

- Are EU member states

- Apply EU Regulation 883/2004

- Allow aggregation of contribution periods

- Pay proportional pensions based on insured periods

However, administrative processing times and fund structures differ significantly.

Mandracchio Capital Advisory Note

The Croatia pension system is legally structured but administratively nuanced — particularly for foreign retirees combining multiple jurisdictions.

If you are considering retiring in Croatia or assessing pension portability and tax exposure, legal coordination between immigration, tax, and social security law is essential.

For tailored structuring and compliance advisory, Mandracchio Capital provides integrated cross-border pension and residency planning support.