The Digital Euro is no longer a theoretical concept. It is an active policy project of the European Central Bank (ECB) that will shape how Europeans pay, store value, and interact with money in the coming decade.

While public debate often focuses on technology wallets, apps, and infrastructure the real impact of the Digital Euro lies in its legal, economic, and institutional design. How it is regulated, how privacy is protected, and how it integrates with existing financial systems will determine whether it strengthens trust in money or creates new systemic risks.

What Is a Digital Euro?

The Digital Euro is a proposed central bank digital currency (CBDC) issued by the European Central Bank (ECB). It would represent a digital form of the euro, designed to function as official legal tender, just like physical cash but in electronic form.

Unlike bank deposits or private payment apps, a Digital Euro would be a direct liability of the ECB, not of a commercial bank. This means it would carry the same level of state backing as euro banknotes and coins, but could be used for digital payments, both online and potentially offline.

In practical terms, it is intended to:

- Allow individuals and businesses to make digital payments in central bank money

- Serve as a public alternative to private payment platforms and card networks

- Preserve access to risk-free public money in an increasingly cashless economy

How the Digital Euro Differs from Existing Digital Payments

It is important to distinguish the Digital Euro from other common forms of digital money:

- Bank deposits: Money held in commercial bank accounts is a liability of the bank, not the central bank.

- Payment apps and cards: These are private systems that rely on banks or card networks as intermediaries.

- Cryptocurrencies and stablecoins: These are privately issued assets without direct state backing and with varying levels of regulatory oversight.

By contrast, it would combine the legal status of cash with the convenience of digital payments, placing it in a unique legal and financial category.

“These issues are less pronounced as long as there is broad access to cash payments. However, if the use of cash were restricted, these problems would escalate significantly. The digital euro is designed to exist as a digital means of payment similar to cash.”

— Prof. Dr. Šime Jozipović

This distinction is particularly relevant for founders and investors navigating compliance when they open a bank account in Croatia, where EU banking rules and ECB policy directly apply.

Is the Digital Euro Meant to Replace Cash?

Officially, no. The ECB has stated that it is intended to complement cash, not replace it. However, in practice, a fast, simple, and free digital payment instrument could gradually reduce reliance on physical cash, especially for everyday transactions.

This is why its design raises important questions about:

- Privacy and anonymity

- State control over transactions

- The future role of cash in society

“Although the European Central Bank does not intend to abolish cash directly, the fact that the digital euro represents a fast, simple, and free payment instrument for end users could result in it significantly displacing cash in practice.”

— Prof. Dr. Šime Jozipović

Why the Digital Euro Exists

The global expansion of cryptocurrencies, fintech payment platforms, and instant cross-border transfers has fundamentally changed how value moves, often outside the traditional banking system.

Key developments include:

- Instant payments via fintech apps

- Cross-border transfers using crypto-assets

- Disintermediation through smart contracts

- Declining use of physical cash

These innovations offer efficiency, but they also challenge monetary sovereignty, financial stability, and regulatory oversight.

As a response, central banks worldwide have launched Central Bank Digital Currency (CBDC) projects. The Digital Euro is the European Union’s answer: a central-bank-issued digital form of money, designed to function as legal tender in the digital economy.

These regulatory shifts matter not only at the EU level, but also for companies doing business in Croatia, where banking, compliance, and payment rules closely follow EU monetary policy. It may also affect tax reporting and transparency within national frameworks such as the Croatia tax system, particularly as digital payments become more traceable.

The ECB’s Digital Euro Project

The ECB began work on the Digital Euro in 2020. Since then, it has progressed through research and preparatory phases and is now building the technological infrastructure required for testing.

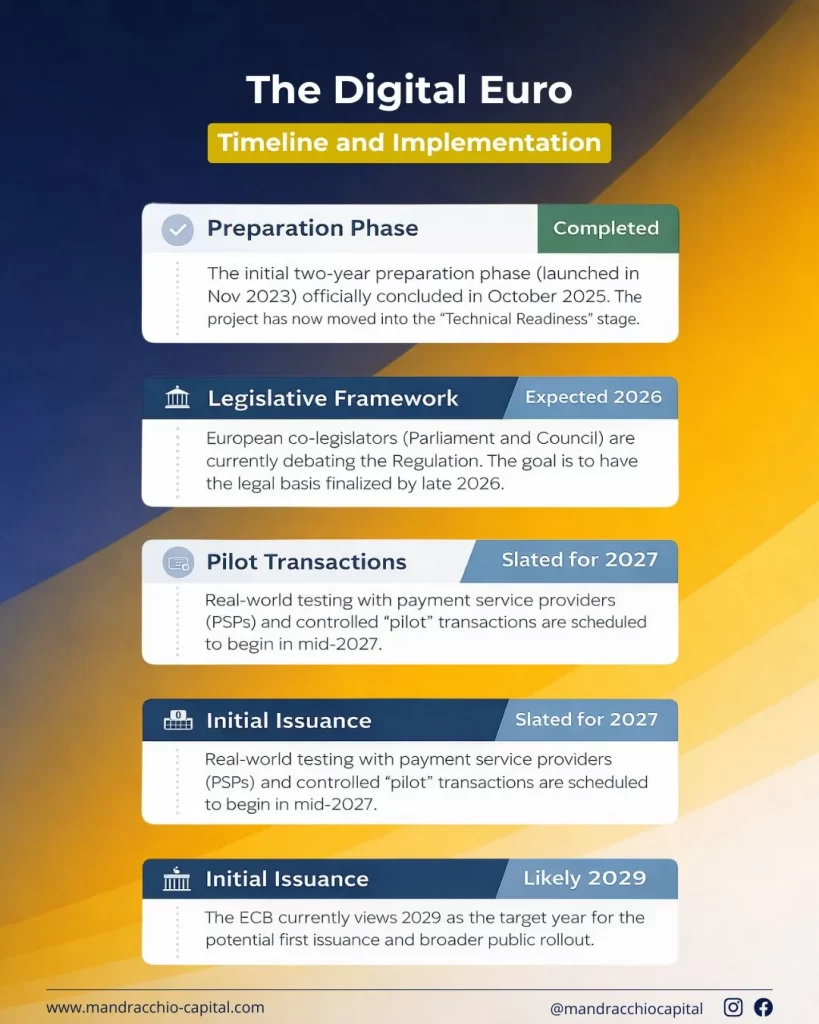

Current expectations indicate:

- Legislative framework: targeted for completion by 2026

- Pilot transactions: potentially starting in 2027

- Broader issuance: realistically expected around 2029

However, this not merely a technical project. Its implementation requires a comprehensive legal framework, balancing multiple public interests:

- Anti-money laundering (AML) and counter-terrorist financing

- Tax compliance

- Consumer protection

- Privacy and data governance

- Integration with existing banking regulation

Legal and Financial Foundations: Insights from Recent Research

These issues are explored in depth in the scientific monograph: “The Digital Euro and Cashless Payments: Legal Regulation and Impact on the Financial System” (Published by Marko Perkušić and Šime Jozipović)

The book brings together leading legal and financial scholars to examine the Digital Euro from multiple perspectives.

Key Themes from the Book

1. Digital Euro vs. Existing Payment Instruments

The Digital Euro would introduce a new cashless payment option with legal tender status equivalent to cash, raising novel legal questions about payment mechanisms, privacy, and system stability.

2. Privacy, Anonymity, and Legal Tender

One of the most sensitive issues is how privacy can be preserved in a system that must also prevent financial crime. Regulatory design choices such as limited anonymity for small transactions will be decisive for public trust.

3. Digital Euro vs. Electronic Money

Although legally distinct, the Digital Euro shares technical similarities with electronic money, such as digital wallets and offline functionality. Understanding these parallels helps clarify regulatory boundaries.

4. Digital Euro vs. Deposit Money

Unlike bank deposits, which are liabilities of commercial banks, the Digital Euro would be a direct liability of the ECB. This distinction has major implications for contractual relationships, banking intermediation, and systemic risk.

5. Digital Euro vs. Cryptocurrencies

Unlike crypto-assets, the Digital Euro would be fully guaranteed by the ECB. While it does not fall under crypto regulation such as MiCA, certain regulatory concepts particularly around AML remain relevant.

For startups and foreign investors involved in company formation in Croatia, understanding the legal nature of digital money is becoming increasingly important.

Risks, Trade-Offs, and Legal Tensions of the Digital Euro

The Digital Euro introduces real opportunities but also structural risks that go beyond technology and into law, governance, and civil liberties.

As legal and financial experts Jozipović and Perkušić explain:

“As it is increasingly likely that the digital euro will become a reality in the European Union, we believed it was useful to publish a comprehensive analysis of its legal and economic effects, as well as the potential risks of its introduction, before its implementation.”

Their analysis brings together perspectives from law, finance, public administration, and banking, addressing issues such as the impact of issuing large amounts of new digital money on euro stability, cybersecurity exposure, and most critically the legal classification of the digital euro itself.

“In this segment, the risks of centralized monetary control and the loss of part of users’ privacy are particularly pronounced,” they emphasize.

One of the core legal challenges lies in balancing users’ fundamental rights with the state’s regulatory responsibilities:

“One of the key legal risks lies in balancing the protection of users’ legitimate rights to property and privacy with the responsibility to prevent money laundering and other criminal activities.”

The authors also warn that these tensions are currently mitigated by the continued availability of cash:

“These issues are less pronounced as long as there is broad access to cash payments. However, if the use of cash were restricted, these problems would escalate significantly.”

At the same time, they clarify the policy intent:

“The digital euro is designed to function as a digital means of payment similar to cash.”

Potential Benefits

- Preservation of central bank money in the digital age

- Reduced dependence on non-European payment networks

- Improved payment efficiency and cross-border transfers

- Greater resilience of the EU monetary system

Key Risks

- Reduced transactional privacy compared to cash

- Increased centralization of monetary control

- Liquidity and refinancing pressure on commercial banks

- Discretionary powers that could be misused in less democratic system

Cash, Control, and Privacy: A Delicate Balance

As discussed in a recent interview (Split professors and financial experts: ‘The EU is introducing a digital euro, the deadline is known, the state will see every transaction) associate professors at the University of Split, Marko Perkušić and Šime Jozipović, the introduction of a digital euro has become a defined policy objective within the European Union.

Marko Perkušić holds a PhD in the legal regulation of digital payment systems and digital means of payment and is the author of the first university-level textbook on electronic payment law.

Šime Jozipović has conducted research on the legal regulation of emerging technologies in connection with the Harvard Innovation Lab and subsequently combined academic research with professional practice through his advisory firm, Mandracchio Capital, which has also been involved in investments in fintech companies.

They have jointly published numerous scientific articles on cryptocurrencies and digital currencies, were among the first scholars to present research on digital tokens at Sorbonne University, and later contributed to international research initiatives, including projects that informed reforms of digital currency and crypto-asset regulation in North Macedonia.

The Digital Euro is officially framed as a complement to cash, not its replacement. Yet in practice, free, instant, and widely accepted digital payments could significantly reduce cash usage over time.

Restrictions on large cash transactions already exist across the EU, and inflation further erodes cash thresholds. As a result, the introduction of the Digital Euro will almost certainly accelerate the transition toward a less-cash society.

This raises a fundamental question: How much monetary control should public institutions hold in a digital economy and how can individual privacy be preserved?

Timeline and Implementation

The research and preparatory phases have been completed, and the European Central Bank is currently developing the technological infrastructure required for testing. According to current projections, the legislative framework is expected to be finalized by 2026, followed by pilot transactions in 2027. A broader rollout and initial issuance of the Digital Euro is most likely around 2029, which central banks view as the most realistic timeline for practical implementation.

About Mandracchio Capital

Mandracchio Capital was founded by Šime Jozipović, a legal scholar and advisor specializing in financial regulation, digital assets, and emerging technologies.

Before establishing Mandracchio, Šime conducted academic research on the legal regulation of digital payment systems and emerging technologies in connection with the Harvard Innovation Lab. His research focused on central bank digital currencies, electronic payments, and the regulatory challenges of fintech innovation within the European Union.

He later transitioned from academia into advisory practice, building Mandracchio Capital as a bridge between regulatory theory and real-world implementation. The firm has been involved in advisory work and investments across fintech, blockchain infrastructure, SaaS platforms, cybersecurity solutions, and green technologies.

Šime is also a registered mentor within a HAMAG-BICRO entrepreneurship and innovation programme, Croatia’s national public agency for SME development and innovation financing, where he advises founders on digitalisation, regulatory compliance, capital structuring, and cross-border business development.

He is co-author of the scientific monograph “The Digital Euro and Cashless Payments: Legal Regulation and Impact on the Financial System”, one of the first comprehensive legal analyses of central bank digital currencies within the EU framework.

FAQ

What is a Digital Euro?

A Digital Euro is a proposed form of central bank money issued electronically by the European Central Bank. It would function as legal tender, like cash, but in digital form. Unlike bank deposits, which are liabilities of commercial banks, the Digital Euro would be a direct claim on the ECB. It is intended to provide a public, state-backed option for digital payments in the euro area.

How Is It Different from Bank Money?

Today, most of the “digital money” people use is commercial bank money, meaning it is a claim against a private bank. The Digital Euro would instead be central bank money in digital form.

Is the Digital Euro the Same as Cryptocurrency?

No. The Digital Euro is not a cryptocurrency.

Cryptocurrencies like Bitcoin or Ethereum are decentralized, privately issued, and not backed by any government. The Digital Euro would be issued and guaranteed by the European Central Bank (ECB) and would be legal tender across the Eurozone.

Will the Digital Euro Replace Cash?

No. The ECB has repeatedly stated that the Digital Euro is intended to complement cash, not replace it.

Physical euro banknotes and coins would remain in circulation. The Digital Euro would simply provide an additional option for payments in an increasingly digital economy.

Who Will Be Able to Use the Digital Euro?

The Digital Euro is expected to be available to:

- EU citizens and residents

- Businesses operating in the Eurozone

- Potentially non-EU residents with a valid EU banking or residency connection

Final eligibility rules are still under discussion.

Should Expats or Retirees in the EU Care About the Digital Euro?

Yes, especially if you:

- Rely on cross-border payments

- Hold funds in multiple EU countries

- Want a risk-free form of digital money backed by the ECB

For most people, daily usage may look familiar but the legal nature of the money is very different.

Any interaction with the Croatian financial system from banking to taxation also requires a Croatia OIB number, which remains essential regardless of whether payments are made digitally or in cash.

What Is Still Unclear?

The project is still under development. Some aspects remain undecided, including:

- The final technical architecture (centralized, distributed, or hybrid)

- The exact privacy model

- The design of offline functionality

- The precise role of banks as intermediaries

The ECB has not finalized the full feature set.